What City Observatory did this week

1. The economics of fruit, time, and place. Last week, Paul Krugman, fresh off his European vacation, waxed poetic about the fleeting joy of summer fruit, and true to form, may an economic argument about how this illustrates the value of such perishable time-limited experiences. Here in Portland, we’re in the midst of the brief season of Hood strawberries, a fragile, juicy fruit that puts the crunchy industrial strawberry to shame, and which is available only for a few weeks just prior to the Solstice. You can only enjoy the Hoods for a few weeks, and because they don’t travel, only in a few places. More broadly though, as Jane Jacobs pointed out, its that kind of distinctive, highly local attribute that’s one thing that places can’t have competed away. In an era of globalization and technology that makes so much of our lives ubiquitous and indistinguishable from place to place, its the little, local, time-limited things that will matter more and more.

2. How to deal with gentrification: TIF for affordable housing. The hallmark of a gentrifying neighborhood is rising property values, and increasing rents may make it difficult for low and moderate income households to stay in the neighborhood. What if we could harness some of the wealth creation that takes place with revitalization to assure mixed income housing? One model is to use tax increment financing, capturing a portion of the increased property taxes from new development, and from appreciation, and using that to subsidize affordable housing. Portland has had such a policy for more than a decade, and has raised a quarter of billion dollars for affordable housing, and built more than 2,000 affordable units in its hottest new upscale neighborhood, the Pearl District. Unlike inclusionary requirements TIF set-asides don’t discourage new housing investment, and automatically generate new revenue in proportion to the rate of property value escalation. It’s a policy that could assure mixed income development and dramatically reduce displacement.

Must read

1. Asset-building policies for people who don’t own homes. For too long, our principal national strategy for encouraging saving and wealth creation has been subsidizing home ownership. A combination of generous tax benefits, guarantees for mortgage lending, infrastructure construction, and protective local zoning have helped many Americans to build wealth by owning a home. But as the Brookings Institution’s Jenny Schuetz argues, we’ve done precious little to help the 40 percent or so of Americans who rent to build assets, and effectively treat renting as a “tenure of last resort.” In addition, home ownership can be an expensive and risky proposition, especially for low and moderate income households. Schuetz advocates tapping the insights of behavioral economics to create more “nudges” to support and encourage everyone to save money in a more diversified, less risky fashion.

2. Uber and Lyft: Scourge and Scam? Hubert Horan has carved out a position as one of the most thoughtful and persistent critics of the ride-hailing industry, and in the wake of Uber and Lyft’s public offerings, has weighed in with a lengthy essay questioning their economics (and just about everything else). Horan argues that the growth of Uber has been driven almost entirely by the company’s decision to have venture capital (and now shareholders) underwrite billions of dollars in losses to provide rides below costs.

Uber’s massive subsidies were explicitly anticompetitive—and are ultimately unsustainable—but they made the company enormously popular with passengers who enjoyed not having to pay the full cost of their service.

Massive subsidies are plainly unsustainable. If it’s ever to turn a profit, Uber will have to raise prices. Higher prices will check its growth rate, and create room for other entrants, perhaps ones that can replicate Uber’s technology, while offering driver/owners a bigger share of the take. Unless the company can erect and maintain barriers to entry–and Horan argues that’s effectively impossible–the ride hailing industry, and Uber’s role in it, is going to look very different–and shareholders should be prepared for a bumpy ride.

As an aside, it’s worth noting that sweeping, unsustainable (and counterproductive) subsidies for car rides are nothing new. Nearly a century of public policy, in the form of publicly subsidized road construction, the devotion of huge amounts of public space to socialism for private car storage, to shifting the costs of crashes, air pollution and climate destruction to society at large have fueled the growth of the automobile industry. That set of policies were a template for the-ride hailing industry, and coupled with the low hanging fruit of a poorly managed, technologically obsolete taxi cartel, and a gullible set of “we’re looking of the next Amazon” investors produced the business models we see today.

New Knowledge

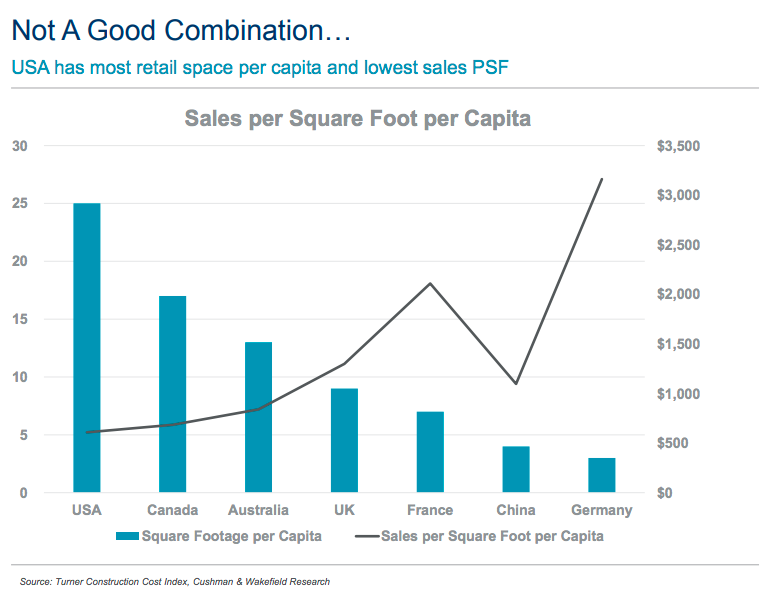

How overstored is America? Technically, this qualifies as old knowledge rather than new knowledge, but it bears repeating just the same. Despite the steady attrition of mass market retailers and wave after wave of store closures, the US has vastly more retail store space than almost every advanced country. We draw on a 2017 Cushman Wakefield comparison of the US market with other large nations. In the US, we have about 70 to 100 percent more square feet per capita than other sprawling anglophone nations (Canada, Australia), and three to five times more square feet than more compact, urban European nations (Germany, France and the UK).

It’s also worth noting that in these countries, the retail square footage is much more productive, the average square foot in France generates $2,000 in sales per year, more than four times the average of about $500 per square foot in the US. These data suggest that we could get by with many fewer stores and much smaller ones.