What City Observatory did this week

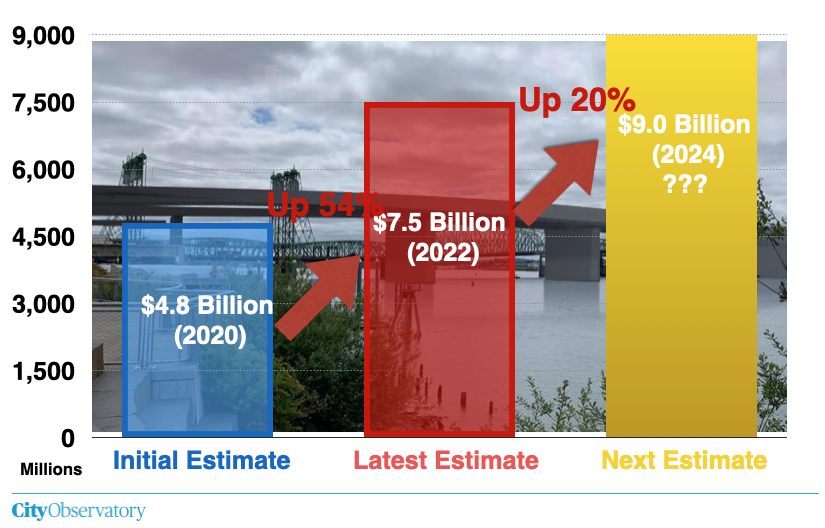

A $9 billion Interstate Bridge Replacement Project? Just 13 months after raising the price of the Interstate Bridge Replacement (IBR) project by more than 50 percent, the Oregon and Washington DOTs say it will cost even more. We estimate project costs are likely to increase 20 percent or more, which would drive the price tag to as much as $9 billion, almost double the 2020 estimate..

While the DOTs blame “inflation” their own estimates show construction cost disinflation, with expected increases of no more than 3.5 percent per year for the rest of the decade. The likely increase in costs will more than wipe out the $600 million in federal funds awarded to the project in December. The cost of the IBR is increasing faster than the DOTs can find money to pay for it.

The “Cost Estimate Validation Process” (CEVP) that state DOTs implied would remedy future cost increases utterly failed. The use of lowballed construction cost estimates to sell highway megaprojects is part of a consistent pattern of “strategic misrepresentation.” It’s the old bait-and-switch: get the customer to commit to buying something with a falsely low price, and then raise the price later, when its too late to do anything about it.

ODOT has a consistent track record of lowballing pre-construction cost estimates, and recording huge cost overruns, with the average price of a major project doubling between pre-construction estimates and final costs.

Must Read

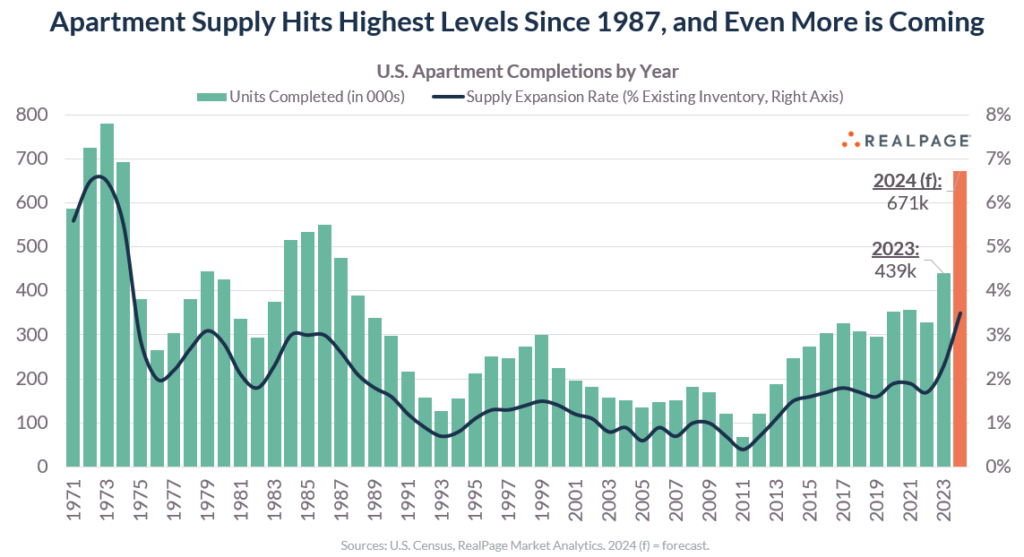

Housing is up, rents are down. Jay Parsons of Realpage reported that 2023 was a banner year for apartment completions. In 2023, the US completed nearly 440,000 new apartments, the highest number in about 35 years.

The surge in apartment construction has been a key factor in bringing down rental price inflation–something that will increasingly show up in the national inflation numbers in the coming year. But real estate markets are local, and the big improvements in supply are producing the greatest rent relief in those markets that are building the most. As Parsons writes,

. . . there remains a clear link between supply and rent change by market. Rents fell in 2023 across 40% of U.S. metro areas – and nearly all of those saw significant new supply entering the market. By comparison, nearly one-third of U.S. metro areas produced rent growth of 3% or more in 2023, and nearly all of them had little supply to work through.

The good news is that the surge in apartment completions is likely to continue through 2024, with more than 650,000 new apartments expected to be finished. There’s clear evidence that expanding supply helps making housing more affordable.

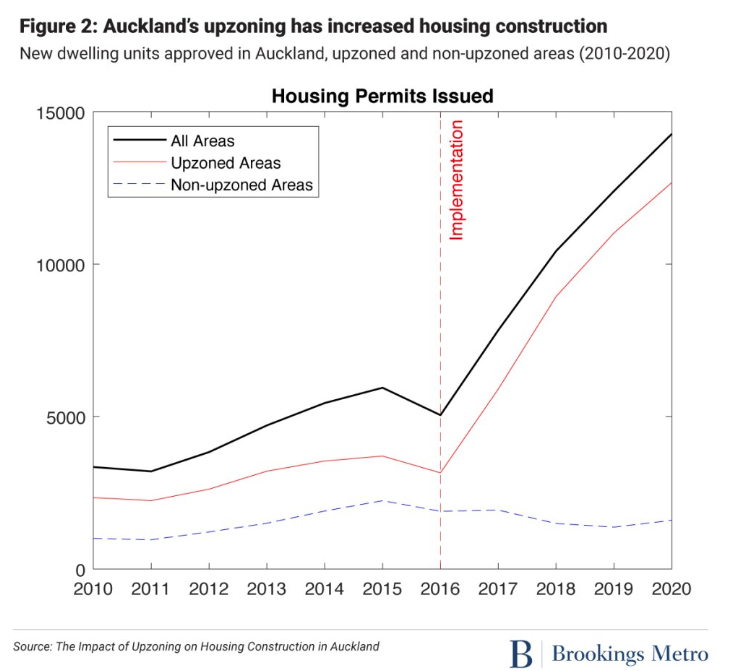

Upzoning increases supply and lowers rents. The principal policy tool that local governments wield to regulate housing supply—zoning—turns out to be a critical way to improve housing affordability. Todd Litman summarizes the growing global literature showing how upzoning leads to more housing construction, and in turn, improves housing affordability. Writing at Planetizen, Litman surveys a series of careful academic studies documenting the positive effects of upzoning. One of the most striking examples comes from Aukland, New Zealand, which saw big increases in housing following its upzoning in 2016:

Whether the present surge in apartment construction continues, and whether it reaches the markets that need additional supply the most, will hinge in important ways, on whether local governments upzone for more supply.

Some state DOTs are climate deniers. More than 20 states are suing the US Department of Transportation over regulations that would require state Departments of Transportation—which receive billions of dollars of federal funds—to measure and report the greenhouse gas emissions associated with their transportation systems. Streetsblog reports that this dirty dozen and a half don’t want to have to even discuss the fact that the systems that they run are now the single largest source of greenhouse gas emissions in the US. As Transportation for America’s Beth Osborne says, the state DOTs are either dishonest or climate deniers (or both):

“They’re saying they don’t have the capacity to measure greenhouse gas emissions, and in the same [document], they’re saying they do; I’d like to know which it is,” Osborne said. “Do they have the information, and they could share it, but they just don’t want to? Or are they unable to determine the carbon impacts of their investments? … Because if they can’t, maybe we shouldn’t entrust them with this money in the first place — and give the money to the cities, which could.”

This lawsuit is just part of a pattern and practice in the transportation engineering industry to deny climate change: As we’ve pointed out, they’re content to build us a highway to hell.

In the News

Streetsblog also pointed its readers to our critique of the flawed USDOT claim that the latest National Household Travel Survey shows a decline in travel.

Writing at Planetizen, Todd Litman cited our debunking of USDOT’s infographic purporting to show a decline in trip making, based on a flawed comparison of two very different household travel surveys.