Portland and Oregon leaders shouldn’t commit to a $5 billion project without an investment grade analysis (IGA) of toll revenues

Not preparing an IGA exposes the state to huge financial risk: It will have to make up toll revenue shortfalls,

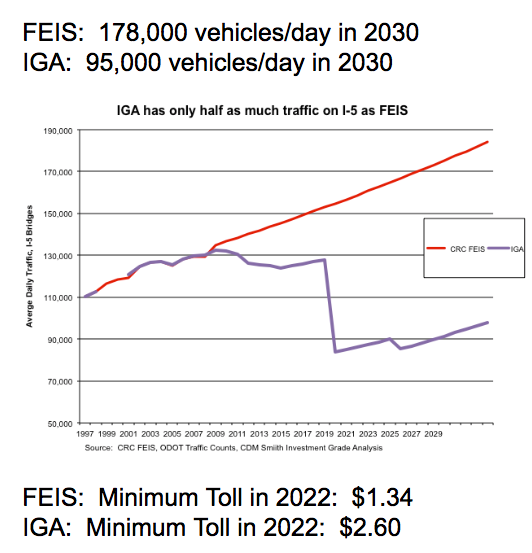

The difference between an IGA and ODOT forecasts is huge: half the traffic, double the toll rate.

There’s no reason to delay preparing the investment grade analysis: The federal government and financial markets require it, and all of the needed information is available

If you don’t prepare an IGA before making a commitment to this project, you are flying blind

Portland are a leaders are being asked to greenlight the so-called Interstate Bridge Replacement Project, which is projected by its proponents to cost as much as $5 billion. But they’re being asked to give a project a go-ahead with only the sketchiest financial information. The project’s cost estimates are slightly warmed over versions of decade old estimates prepared for the failed Columbia River Crossing. Ominously, the details of where the money will come from—who will pay and how much—are superficial and vague.

One thing project advocates grudgingly admit is that the I-5 bridge replacement can’t be financed without tolls. Program administrator Greg Johnson and Oregon Transportation Commission Chair Bob Van Brocklin have repeatedly said as much. But how much money tolls will produce and how high tolls will be are never clearly mentioned. Johnson has said tolls will provide “about a third of project costs.”

Knowing how much money tolls will produce, and how high tolls will have to be to produce that revenue is the central financial question.

Currently the I-5 bridge carries about 130,000 vehicles per day. But that volume is predicated on the bridge being free. Charging people to use the bridge would dramatically reduce the number of crossings. As we’ve documented at City Observatory, when tolls were added to a similar crossing, the I-65 bridges across the Ohio River in Louisville, traffic levels fell by half.

Because tolling depresses traffic, you can’t accurately estimate how much toll revenue a bridge will produce without a detailed model that accounts for this traffic depressing effect.

The models routinely used by state highway departments don’t accurately account for the effect of tolling on traffic volumes. They tend to dramatically over-predict the amount of traffic on tolled roadways, which has led to over-built facilities that don’t generate enough toll-paying traffic to cover their costs.

Financial markets and the federal government, who are asked to loan money up-front (with a promise to be repaid by future tolls) simply refuse to believe state highway department traffic forecasts. Instead, they insist that states pay for an “investment grade” traffic and revenue forecast. You can’t sell toll-backed bonds on private financial markets, and you can’t even apply for federal TIFIA loans, without first getting an investment grade forecast. In January, Portland’s Metro Council adopted a statement of Values, Outcomes and Actions governing the I-5 project, directing the Oregon Department of Transportation to prepare an Investment Grade Analysis of the project:

As the part of the finance plan, engage professionals with expertise in financing massive complex transportation infrastructure construction projects to conduct and deliver the results of an investment-grade traffic and revenue study of the design options.

That’s a critical step to making and informed decision.

What is an investment grade analysis?

Investment grade forecasts are generally prepared by one of a handful of financial consulting firms. These studies start with the traffic models used by state highway departments, but make much more realistic assumptions about future population and employment growth, the likelihood of economic cycles, and critically, the effect of tolling on levels of traffic. As a result, investment grade analyses invariably predict lower levels of traffic that the models used by state highway departments. Because traffic levels are lower, tolls have to be higher to produce any given amount of revenue.

And the differences between investment grade analysis and highway department forecasts are not trivial: they are huge. The Oregon and Washington highway departments prepared traffic and toll estimates for the Columbia River Crossing’s Final Environmental Impact Statement published in 2011. Those estimates were that the I-5 bridges would carry 178,000 vehicles per day in 2030, and that minimum tolls would be $1.34 to pay for about one-third of the cost of the project. The Investment Grade Analysis for this project, prepared by CDM Smith on behalf of the two agencies in 2013 estimated that in 2030, the I-5 bridges would carry just 95,000 vehicles per day in 2030, and that tolls would be a minimum of $2.60 each way in order to cover a third of project costs. In short, the initial highway department estimates overstated future traffic levels by double, and understated needed tolls by half.

The starkly different figures in the investment grade analysis called into question the size of the project, which was predicated on the exaggerated highway department forecasts. If a tolled bridge would carry dramatically fewer vehicles than the existing bridge, there was no justification for building an expensive wider structure and approaches. The money spent expanding capacity on the bridge would be wasted because fewer vehicles would use it. Also, the dramatically different traffic figures also meant that the environmental analysis contained in the FEIS was simply wrong.

Investment Grade Analyses are required for financial prudence

The reason that the federal government and financial markets insist on the preparation of an investment grade analysis is so that they don’t get stuck holding the bag when traffic levels, and toll revenues fall short of the excessively optimistic expectations of state highway departments. Around the county dozens of toll roads and bridges have failed to produce expected revenues, leading to delinquencies, defaults, and bankruptcies.

If anything, state lawmakers have an even larger financial stake in the IBR project than do financial markets or the federal government. Financial markets, for example, will insist on additional state guarantees, besides repayment just from the stream of toll revenues. They’ll require states to pledge other revenues to repay bonds, in addition to insisting on the investment grade analysis. The 2021 Oregon Legislature passed HB 3055, which authorizes ODOT to pledge state gas tax revenues and future federal grant monies to repay holders of state-issued toll bonds.

Because the state is ultimately liable for any toll-revenue shortfalls, it has an even higher stake than private lenders or the federal government in knowing the true level of future toll revenues as would be disclosed in an investment grade analysis.

Why ODOT doesn’t want the public to see the IGA first

ODOT and WSDOT are greatly resisting calls to prepare an investment grade analysis. Their current project schedule doesn’t call for conducting the analysis until 2024 or 2025–well after the design of the bridge is settled and too late to consider a smaller or cheaper alternative. The highway departments variously claim that its “too expensive” or “premature” to carry out the IGA.

There’s no technical reason it can’t be prepared now. The base transportation data have been gathered, and the regional model exists. The agencies say the IGA is expensive, but it’s far less costly than what the agency has spent already on public relations, and the money has to be spent anyhow. And the IGA will continue to be valid for several years—and can easily be updated once it is complete, if that becomes necessary. You can’t save any money by delaying. The only real reason to put off preparing an IGA is because it will show that the IBR will carry vastly less traffic than the DOTs predict, and that tolls will have to be much higher than they’re implying. In short, the DOTs don’t want the IGA because it will present a definitive case against the over-sized project that they’re building. Financial markets and the Federal government will insist on the IGA before they make their decision: the only ones being denied access to this vital financial information are local leaders and state lawmakers who will have to pay for the project. According to DOT plans, they’ll find out the results of the IGA only after it’s too late to do any good.

Their plan is clearly to convince local and state leaders irrevocably commit to the construction of a much larger project than could possibly be justified it anyone saw the results of the investment grade analysis. It’s obvious from the project’s unwillingness to do anything other than advance a single alternative (a 164-foot wide bridge, enough for ten or twelve lanes of traffic) into the next environmental analysis, that they don’t want the results of an investment grade analysis to undercut their contrived case for a massive structure.

State Highway Department Forecasts are Flawed

As we’ve written before, the IBR project is a scene-for-scene remake of the Columbia River Crossing debacle. Just as they are doing now, the state highway departments published grossly inflated traffic forecasts. In 2010, the Oregon State Treasurer hired Rob Bain, an internationally recognized expert on toll revenue financing, and author of “Toll Road Traffic and Revenue Forecasts: An Interpreters Guide” to assist in the financial analysis of the CRC. He found numerous flaws and biases–which prompted calls for the investment grade analysis that produced dramatically different results than the highway department projects. Specifically, Bain reviewed the CRC traffic and revenue forecasts prepared for the project’s environmental impact statement on behalf of the Oregon State Treasurer. He stated:

- The traffic and revenue (T&R) reports fall short when compared with typical ‘investment grade’ traffic studies. As they stand they are not suitable for an audience focussed on detailed financial or credit analysis.

- The traffic modelling activities described in the reports are confusing and much of the work now appears to be dated. Although a number of the technical approaches described appear to be reasonable, many of the modelling-related activities seem to ‘look backwards’; justifying model inputs and outputs produced some years ago. There is a clear need for a new, updated, forward-looking, comprehensive, ‘investment grade’ traffic and revenue study.

- No mention is made in the reports of historical traffic patterns in the area or volumes using the bridges. This is a strange omission. Traffic forecasts need to be placed in the context of what has happened in the past. If there is a disconnect (between the past and the future) – as appears to be the case here – a commentary should be provided which takes the reader from the past, through any transition period, to the future. No such commentary is provided in the material reviewed to date.

- Traffic volumes using the I-5 Bridge have flattened-off over the last 15-20 years; well before the current recessionary period. . . . the flattening-off is a long-term traffic trend; not simply a manifestation of recent circumstances. The CAGR for the period 1999 – 2006 reduces to 0.6%

An investment grade analysis is the bare minimum that’s needed to make a responsible and informed decision about a multi-billion dollar project. The only reason not to ask these questions now, and to get clear answers, is because the two state DOTs know that the financial risks will prompt legislators and the public to seriously question this massive boondoggle.

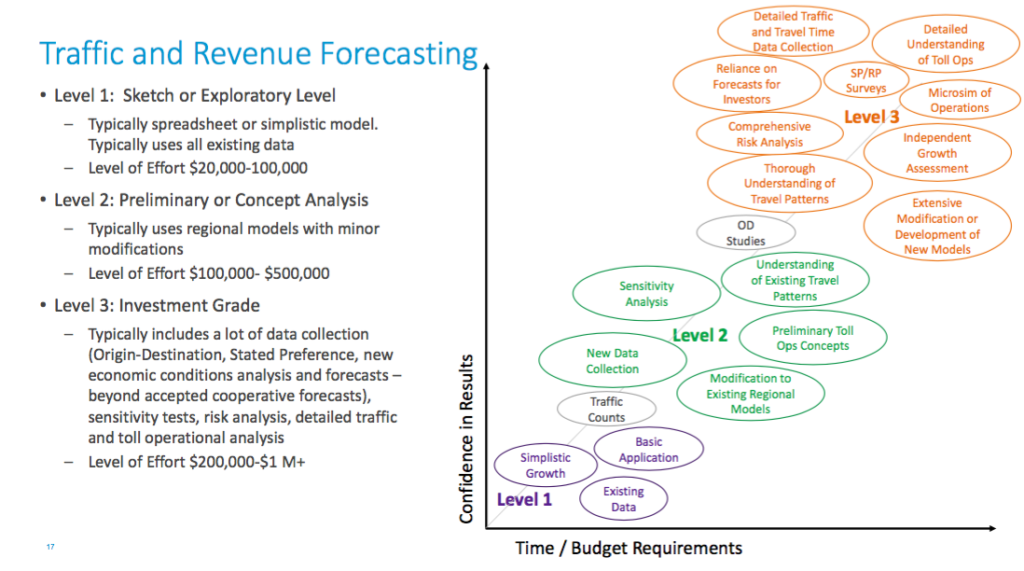

A note on nomenclature: Level I, Level 2, Level 3

Highway departments frequently label traffic forecasts as being one of three levels, ranging from a rough sketch level (Level 1), to a somewhat more detailed Level 2, and up to the financial gold standard, Level 3, an investment grade analysis. As noted, neither the federal government nor private bond markets will make loans based on Level 1 or Level 2 studies: they are inadequate to accurately forecast traffic for making financial decisions. This chart from Penn State University describes the general differences between these three levels of analysis: