Home buying is a risky bet: There’s a 30% chance your house will be worth less in five years

It’s a widely agreed that promoting homeownership is a key means to help American households build wealth. But as we and others have argued, homeownership can be a risky and problematic investment for many households–and is fundamentally at odds with the other pillar of housing policy–that housing ought to be affordable.

The latest reminder of the risky business of home ownership comes from financial blogger Felix Salmon, writing at Axios:

You wouldn’t make a 5x leveraged bet on the S&P 500 — not unless you were an extremely sophisticated financial arbitrageur, or a reckless gambler. Even then you wouldn’t put substantially all of your net worth into such a bet. Stocks are just too volatile. But millions of Americans make 5x leveraged bets on their homes — that’s what it means to borrow 80% of the value of the house and put just 20% down.

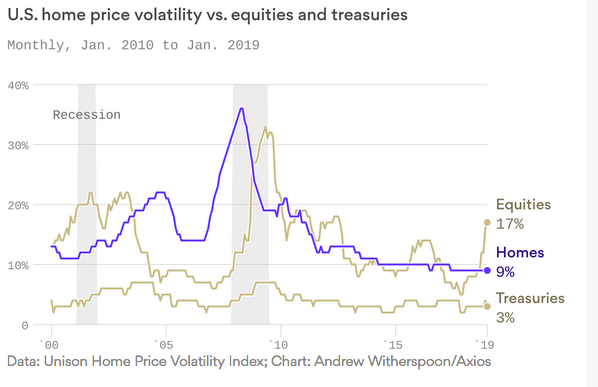

While homes are much less volatile than individual stocks, they’re just as volatile as the kind of diversified stock indices most people invest in.

The bottom line: Any given home has roughly a 30% chance of ending up being worth less in five years’ time than it is today. If you can’t afford that to happen, you probably shouldn’t buy.

Salmon links to data from housing investment firm Unison that plots the volatility of home prices in markets around the country. It turns out that home prices are nearly as volatile as major stock indices:

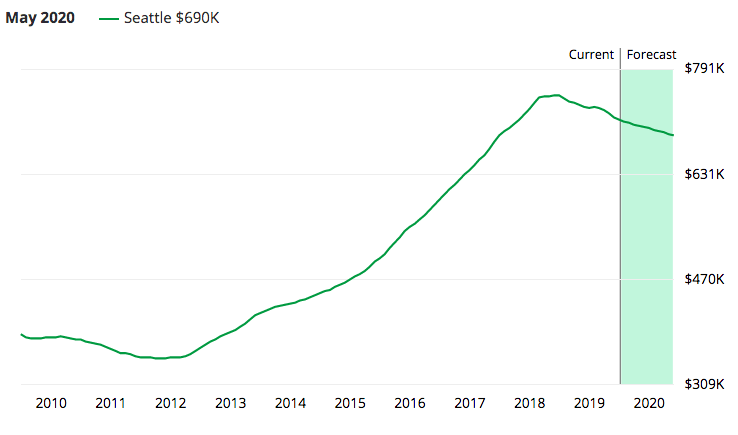

You can observe this volatility in markets around the country. Almost on cue, the latest data for several markets around the country, ones that you wouldn’t expect, is showing how risky housing purchases can be. For example, prices in Portland and Seattle have both declined in the past year, showing that even “hot” markets with strong economies can experience home price volatility. Portland prices are down 1.6 percent over the past 12 months, Seattle’s are down 4.5 percent in the same time, according to Zillow. Zillow also predicts Seattle prices will decline into next year.

Whether homeownership turns out to be a wealth-building, or wealth destroying endeavor depends a lot on timing and luck–you have to buy the right house, at the right time, in the right neighborhood, for the right price. And the way housing and credit markets generally work, the most financially vulnerable households tend to make their housing investments at the wrong time, in the wrong neighborhoods and for the wrong price, and end up paying more both for their homes and their mortgages, putting them in the position of maximum exposure to market volatility.

There’s a wealth of biased information out there about the merits and safety of homeownership. While media reports frequently draw attention to hot markets, and emphasize places where prices are increasing, there is considerable variability. It’s still the case, more than a decade after the housing bust, that inflation-adjusted home prices have yet to recover to their pre-collapse highs. Even in the worst of times, for example, realtors are telling people “it’s a great time to buy a home.” In fact, when it comes to the real estate market, it’s always a good time for the buyer to beware, or at least be aware, of the risks of homeownership.

Note: The commentary has been revised to more accurately characterize the business specialization of Unison.