What City Observatory did this week

What apartment consolidation in New York tells us about housing markets and gentrification. A new study shows that over the past several decades, New York City lost more than 100,000 homes due to the combination of smaller, more affordable apartments into larger, more luxurious homes

When rich people can’t buy new luxury housing, they buy up, and combine small apartments to create larger homes.

If you’re worried about gentrification and displacement, this is a vastly larger problem than new construction–which has been repeatedly shown to lower rents and create more housing opportunities for lower income households.

Must Read

Why Portland’s downtown is doing much better than you’ve been told. Local and national press have flogged downtown Portland’s supposedly tepid recovery from the Covid pandemic based on statistics generated by the University of Toronto. That study looks at pre- and post-pandemic cell phone data for selected neighborhoods in major US cities, and rates Portland second to last for the percentage of activity recovered since 2020. But economist Mary King, writing at Portland’s Street Roots digs into that data and exposes some serious flaws.

The University of Toronto data look at only a single (and unrepresentative) part of downtown Portland (with only about 1,000 residents), and count only changes in unique visitors (effectively discounting daily, repeat travelers. And the study uses widely varying geographies for different cities; San Diego’s counts reflect both its airport and famous Zoo, and naturally shown a dramatic rebound in unique visitor counts. As King reports:

Counting all visits and using a much bigger definition of downtown, the Portland Metro Chamber reports Portland had nearly two-thirds as many visits in June 2023 as in June 2019. In stark contrast, the Toronto study asserts that there were just 37% as many visitors to “downtown Portland” from March through May 2023 as in 2019.

In short, the University of Toronto data don’t offer an apples-to-apples comparison of cities; more robust data suggests that Portland’s experience is similar to other US downtowns.

Fantasy models: Their costs and consequences. David Levinson who blogs at The Transportist, is one of the world’s leading transportation scholars. He’s got a must read essay that debunks the pseudo-science behind traffic modeling, and importantly lays out its consequences for how we build our communities, how we live. These seemingly trivial technocratic details hamstring our ability to think and plan differently. The four-step models used by most transportation planners underpin a “predict and provide” approach to transport investment that fuels more car dependency. As Levinson says:

Overly optimistic models can mislead decision-makers into supporting the wrong transport projects, projects that are not viable, cost-effective, or beneficial to the public. This can result in the approval of projects that might never reach completion or fail to deliver the promised benefits, wasting time, money, and political capital.

Unrealistic models can also contribute to environmentally harmful decision-making. By underestimating the potential impacts of a project on air quality, greenhouse gas emissions, or natural habitats, leads to projects that compromise environmental sustainability and public health.

While the problem is bad models, the solution is not to simply try to make the models somewhat better: Their limitations are inherent. Levinson argues we need to be smaller scale, adaptive and incremental in our approach to transportation.

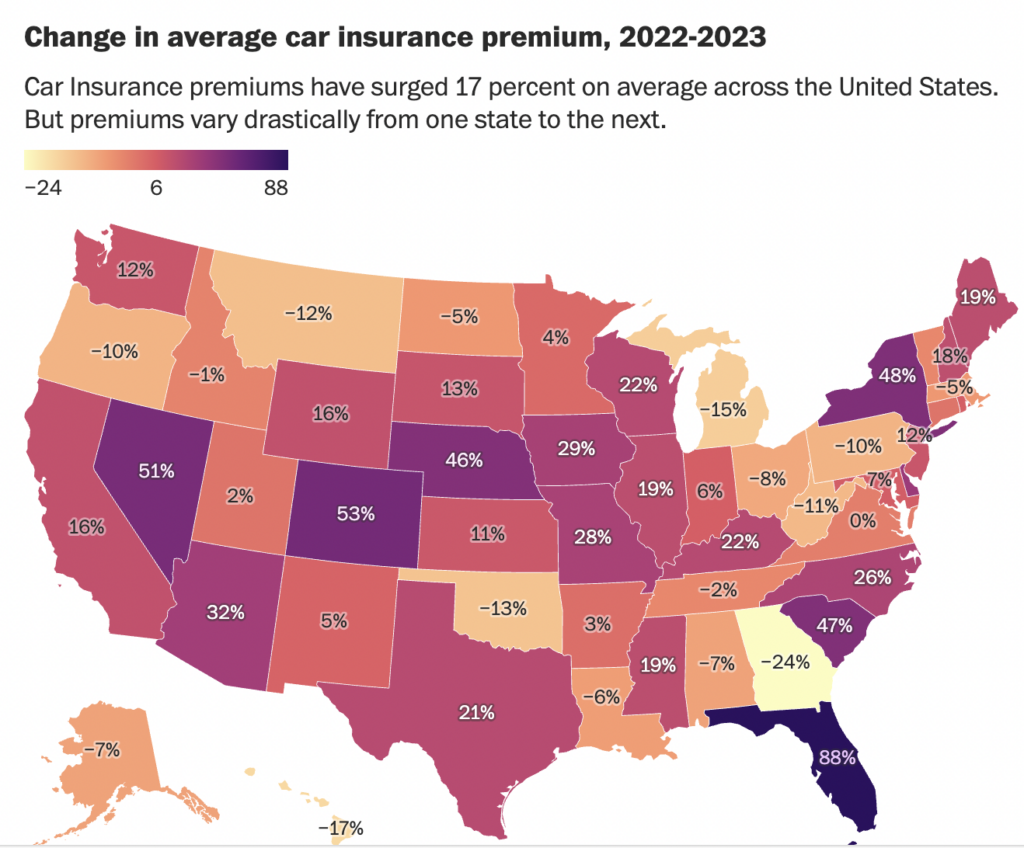

Costlier car insurance. The Washington Post looks at the big jumps in car insurance rates around the country. Higher insurance costs are both a symptom and a cause of inflation: cars are more expensive to replace and repair, and climate has increased losses (especially in state’s with climate driven fire, flood and storm damage). These costs drive up insurance rates, and car insurance is one component of the consumer price index:

Premiums have kept climbing even as other types of inflation have cooled. According to the Bureau of Labor Statistics, car insurance for U.S. drivers in July was 16 percent more expensive than in July 2022, and 70 percent more expensive than in 2013.

While there’s considerable variation across states, most states have seen substantial increases in the past year.

Revived park reconnects Memphis to the Mississippi. Over Labor Day weekend, Memphis opened its revitalized Tom Lee Park.

Reviewing the opening for Fast Company, Nate Berg writes:

In Memphis, Tennessee, a remarkable new public park has just opened. Filling 30 acres along the edge of the Mississippi River with active, social, ecological, and architectural spaces, it could reframe the city’s fading connection to the riverfront. It could also set a new standard for what waterfront parks can do.

Congratulations to City Observatory friend Carol Coletta and Memphis Riverparks for this impressive accomplishment.

New Knowledge

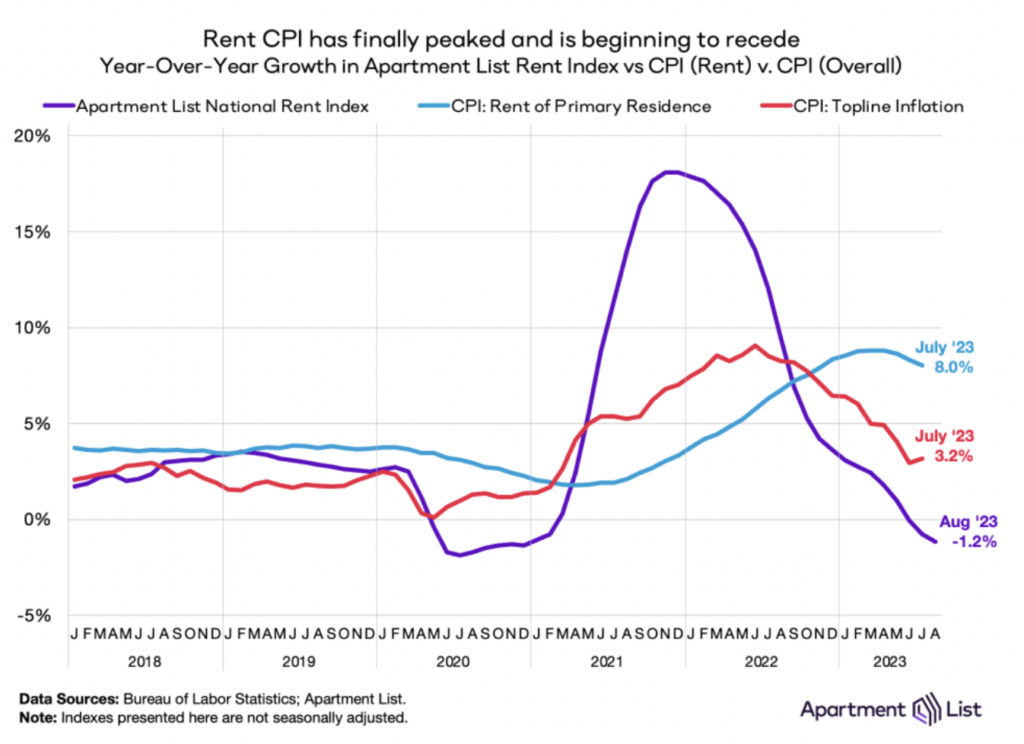

Rent and inflation. ApartmentList.com has some of the most careful, thorough and transparent data and analyses of rental market trends in the U.S. Their latest work sheds light on the connections between overall inflation trends in the US, and ongoing changes in the apartment market.

In 2021 and 2022, a surge in rents as we recovered from the pandemic was a key contributor to the rapid run-up in overall consumer prices. Rents, logically, are a key consumer expense, and higher rents mean higher inflation. But there are key differences between the current market data (as estimated by ApartmentList.com, and others), and the rental price inflation that the Bureau of Labor Statistics uses to compute the official consumer price index. In effect, changes in market rents feed into the CPI, but with a bit of a lag. As a result, looking at ApartmentList.com data gives you a good idea of how the official inflation rate is likely to be affected by changing rents in the months ahead.

That’s why you should pay particular attention to this chart, which shows the ApartmentList.com rental inflation estimate, the BLS rent inflation estimate, and the overall CPI.

As Rob Warnock of ApartmentList.com writes:

The Apartment List National Rent Index has proven to be a strong leading indicator of the CPI housing and rent components, as we captures price changes in new leases, which eventually trickle down into price changes across all leases (what the CPI measures). Because of these methodological differences, when our index peaked with record-setting rent growth in 2021 (+17.8 percent), the rent component of CPI was still just starting to heat up, even as overall inflation had already become a key economic issue for policymakers and everyday Americans. Now in 2023, our index shows that the rental market has been cooling rapidly for a year, but the CPI housing component has just recently hit its peak. Despite the CPI’s measure of housing inflation remaining elevated, topline inflation has already meaningfully cooled. As the CPI housing component now gradually begins to reflect the cooldown that we’ve long been reporting, it will help to further curb topline inflation in the months ahead.

The ApartmentList analysis shows that rents are coming down in most markets around the US, with year over year declines in 72 of the 100 largest markets. This shift is underpinned by fundamentals, including increasing completions of new apartments in most markets, and evidenced by a vacancy rate that is now at pre-pandemic levels. All this bodes well for improvements in housing affordability, overall, in the next year. And this will also show up in reduced rates of headline inflation.

Rob Warnock, Apartment List National Rent Report, September 2023. ApartmentList.com