What City Observatory did this week

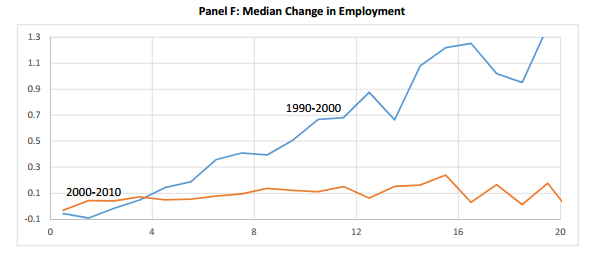

1. More evidence job growth is shifting to city centers. A recent paper by Nathaniel Baum-Snow and Daniel Hartley has some interesting data on the pattern of job growth in the nation’s largest metropolitan areas. They find that while suburban area job growth greatly outpaced that of the central city in the 1990s – basically, the further away from the core you were, the faster you grew – that this pattern totally changed in the decade 2000 to 2010. (Chart shows job growth rate by distance to the CBD, in kilometers).

2. Vancouver’s foreign-buyer tax didn’t slash home prices. This summer, the Province of British Columbia imposed a 15 percent tax on the sale of residences to foreign buyers. Some press accounts described the tax increase as an instant cure for home price inflation, claiming it resulted in an overnight 16 percent decline in home prices. In fact, Vancouver home prices were basically flat; we explain how journalists made a fundamental error in examining the data; one that is unfortunately all too common in reporting on real estate trends.

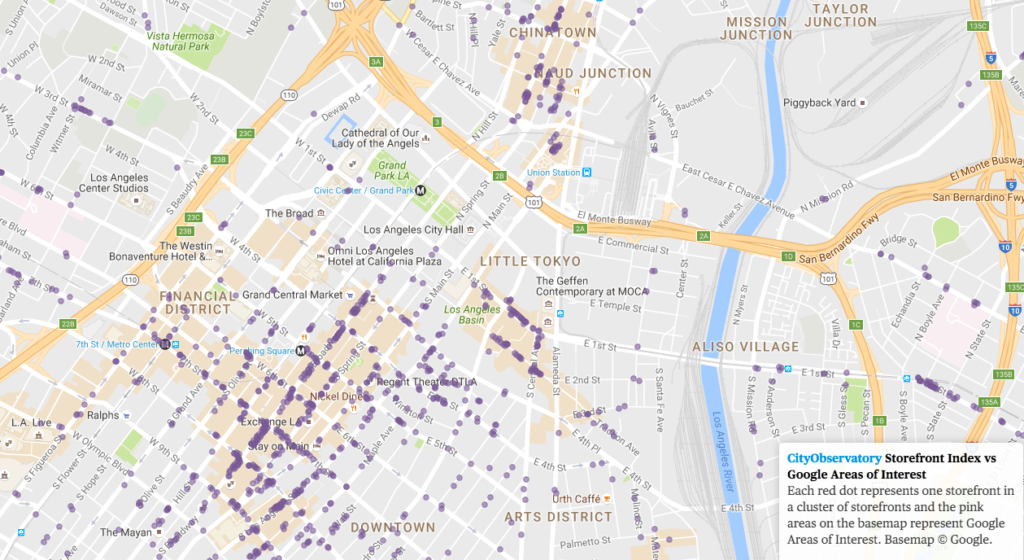

3. The most interesting neighborhood in the world. Google Maps has added a new feature, areas of interest, which show up as peach-colored blotches. Its not entirely clear how Google selects these areas, and some observers are concerned that there may be hidden biases at work. Using City Observatory’s Storefront Index, we’ve looked to see how the clustering of consumer-facing retail and service businesses corresponds to the places Google characterizes as interesting. Storefront clusters closely correspond to the areas google flags as “interesting.”

4. Where is ridesharing growing fastest? A new report from the Brookings Institution uses federal data on so-called non-employer businesses to track the growth of independent contractors in the “rides and rooms” segment of the gig economy. We use the Brookings data as a proxy for the penetration of transportation network companies like Lyft and Uber in the top 50 metropolitan markets. The leaders are New York, San Francisco and Washington.

This week’s must reads

1. The under-appreciated benefits of public housing. Public housing has long been associated with negative consequences. It’s emblematic of concentrated poverty, and it’s widely believed that large-scale, high density public housing projects breed social pathologies. But a new paper from John Haltiwanger and colleagues challenges that view. Part of the problem of assessing the impact of public housing is the problem of “selection effects” – people who are chosen to live in public housing, by definition, are low income, and suffer from many challenges. The key question is, once chosen to be in public housing, how do children do? Haltiwanger, et al overcome this selection effect problem by looking at the different outcomes for different children within a single household based on the amount of time they live in public housing. Comparing siblings allows the researchers to net out the effects of families (parental education, income, employment, etc), and judge the separate impact of housing itself.

While the impacts are different for boys and girls, the study shows that public housing actually benefits children of poor families over their lifetimes, as measured by income and likelihood of incarceration, (girls see larger gains in income and lower rates of incarceration than boys). This holds for both traditional public housing and housing vouchers. In large part this seems likely to be an income effect: families getting vouchers or living in public housing spend less on housing than they would if they rented in the private market, without subsidies, and therefore have more resources for all their other expenses, which may translate into better outcomes for their children. As we’ve noted at City Observatory, the big problem with our housing programs for the poor is their lack of scale: fewer than one-in-four households that technically qualify for housing assistance get anything. And this study suggests that there could be substantial benefits from expanding the reach of these programs. The full report is available from the National Bureau of Economic Research (NBER): Childhood Housing and Adult Earnings: A Between-Siblings Analysis of Housing Vouchers and Public Housing.

2. Tales of Rent Control John McNellis tells us what rent control looks like from the perspective of a small landlord. His family inherited a small 5-unit San Francisco apartment building which fell under the city’s rent control program. Two of the apartments turned over after they inherited the building, but three tenants were ones who were in place. Rent control created a strong adversarial relationship between the landlord and tenants; one tenant even insisted all communication be in writing. Eventually, McNellis’s family tired of the burden of being landlords, and opted to sell . After the sale, McNellis reports finding out that three of his nominal tenants had actually sublet their apartments — at market rates, “Our apartments were thus rented at market rates: just not by us.” Tens of thousands of apartments, particularly smaller complexes that make up the “missing middle” housing are owned not by big corporations, but by smaller part-time and amateur landlords. Rent control creates strong incentives for them to take their capital and invest elsewhere, with the paradoxical result that the landlord business is further dominated by more ruthless and efficient corporate owners.

New knowledge

1. Housing, Interest Rates and Inequality: Writing at VoxEU, economist Gianni LaCava describes the results of his research looking at the relationship between home prices, interest rates and economic inequality. Digging in to state level data, LaCava confirms what Thomas Piketty and Matthew Rognlie have argued: that the distribution of income and wealth in the United States has become more unequal, and that it has been the growth of housing wealth, in particular, that has been the big driver of inequality. His work also shows that housing prices have accelerated most in those states with the most constrained (i.e. least elastic) housing supply, and that inequality accelerated as real interest rates declined steadily from the 1990s onward. If we’re concerned about inequality, LaCava argues, we need to pay more attention to the distribution of housing wealth, and the “imputed” income that homeowners receive.

2. Home prices and economic mobility in California. California’s Legislative Analyst has produced some of the most insightful examinations of the connections between housing markets and the economy. A new paper by LAO looks at the connection between high home prices in coastal counties (around San Francisco and Los Angeles) and the inland counties of the state. It finds that historically, incomes were converging between the lower income inland counties and the higher income coast counties. But that pattern has reversed in recent years, and that’s attributable to higher housing prices on the coast. The lack of housing has forced more people to live in the interior counties, where economic opportunities and productivity are lower. And significantly, as measured by residual income—the amount of income left after paying housing and transportation costs—incomes are actually lower in these “cheaper” counties, meaning that these families would be economically better off if they could live in one of the coastal counties.