What City Observatory did this week

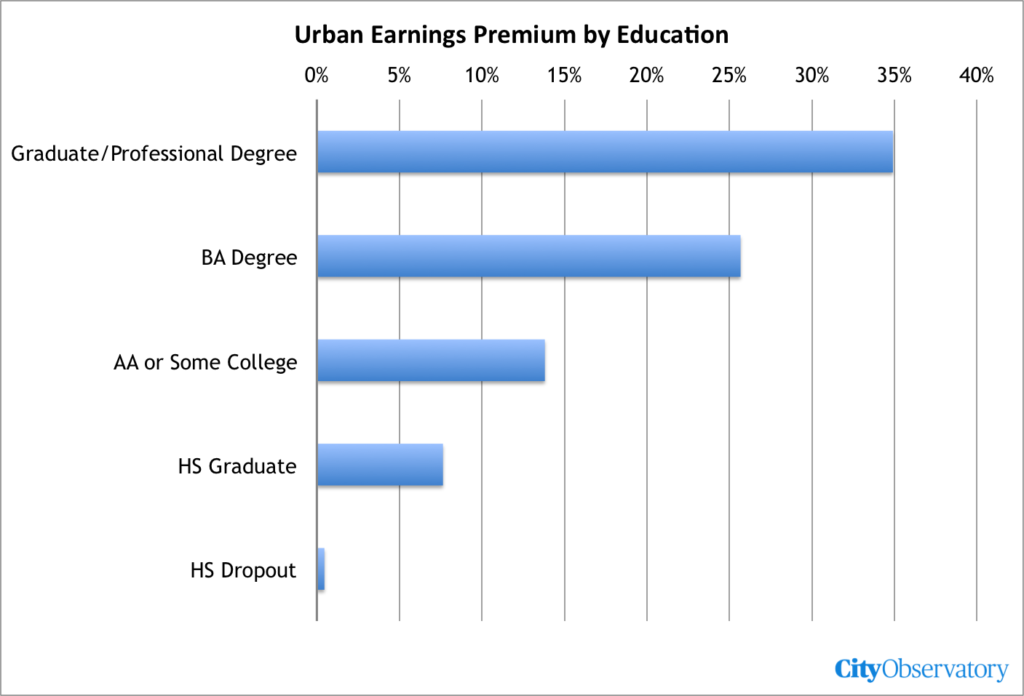

1. Cities and the returns to education. We know that the nation’s best educated people are increasingly concentrated in urban areas. Data compiled by the US Department of Agriculture’s Economic Research Service shows a big reason why: the more education you have the bigger the urban wage premium. College-educated workers make more than those with just a high school education everywhere, but they make proportionately more in cities. Workers, especially well-educated ones, are more productive and better paid if they live in urban economies than rural ones.

2. Integration and the Kumbaya Gap. Even in neighborhoods that have experienced significant racial (and economic) integration in the past few years–like Washington DC’s U-Street–it’s still common to observe that people associate mostly with those with similar backgrounds and demographics. In his new book, Derek Hyra argues that this continuing micro-segregation of integrated neighborhoods means that integration is failing the poor and people of color. But is it? In our view, more integration is a necessary pre-condition for greater social interaction, but just as importantly, it breaks down the isolation and resource deprivation that often plagues poor neighborhoods. For example, we know that poor kids growing up in mixed income neighborhoods have better economic outcomes, than those who grow up in concentrated poverty.

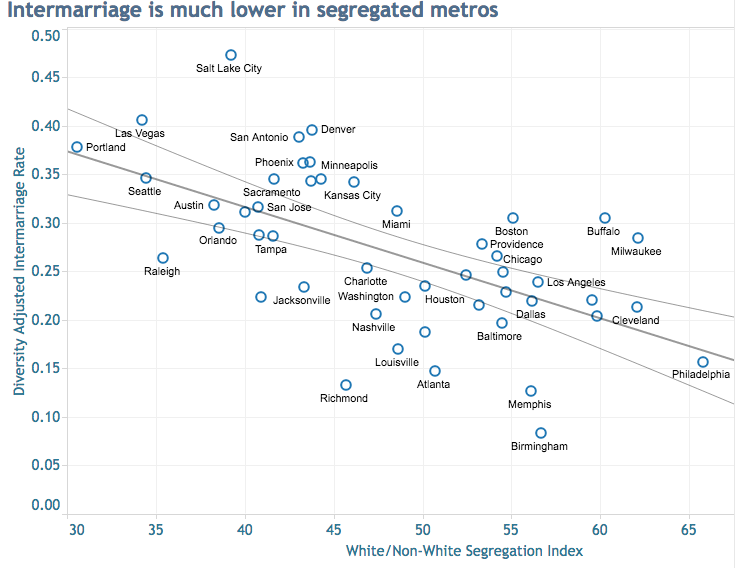

3. Intermarriage and Segregation. Intermarriage–marriages composed of persons from different racial/ethnic groups–are on the increase in the US. They’re up from about 3 percent of all marriages in the 1960s, to about 17 percent of all marriages today. We look at the variation in intermarriage rates across US metro areas, using data from a new analysis released by Pew. The data show that intermarriage is least common in the most segregated metro areas and most common in the least segregated areas. This is powerful evidence that integration tends to fuel more social interaction among people from different racial/ethnic groups.

4. Big data’s hidden bias. A Houston study of “near miss” traffic incidents reported by cyclists and pedestrians, got us thinking about the strengths and weaknesses of big data. The study aimed to improve our understanding of bike and pedestrian safety by looking beyond actual crash data to identify the location of near-misses. In theory, the bigger sample of instances could help identify danger areas. But as the study’s authors note, there’s an important problem: cyclists and pedestrians tend to avoid the most dangerous places, and as a result, the data may be self-censored to exclude from analysis the places that most need improvement. This is one example of a more general problem with gathering big data from existing travel patterns and behavior: it tends to impart a very strong status-quo (and therefore car-centric) bias, and systematically diverts us from asking aspirational questions about what kind of transportation system we’d actually like to have.

Must read

1. A housing market thought experiment. Bloomberg’s Noah Smith weighs in, once again, with more arguments for expanding the supply of housing–even high-end market rate housing–as a way to tackle the housing affordability problem in San Francisco (and a growing list of other cities). A standard NIMBY argument is that building high-end housing makes affordability problems worse (a claim that infuriates economists, but which resonates with many non-economists). To dispel that view, Smith suggests this thought experiment: If you believe that more high priced housing causes affordability problems, then you ought to believe that demolishing high priced housing ought to make housing more affordable. Smith asks his readers to image what would happen in San Francisco if it suddenly demolished a bunch of luxury housing. The wealthy residents of these houses wouldn’t suddenly decamp from the Bay area; instead, they’d bid up the prices of the remaining housing, leading to even more displacement. Housing affordability is profoundly a matter of supply and demand.

2. Why we need market rate housing. Scott Weiner, the San Francisco Supervisor, now turned State Senator, has a long essay diagnosing the roots of that city’s housing affordability crisis, and outlining the policy steps the state needs to take to remedy the problem. Weiner argues: “Market-rate housing isn’t a bad word, and we won’t solve the housing crisis without it.” The public sector can’t build or subsidize enough affordable housing to meet the burgeoning need. Instead, the problem has to be solved by liberalizing zoning and eliminating the procedural roadblocks that stifle new housing production. He concludes: “Anyone who advocates that we ignore these process and zoning problems and instead focus our housing policy exclusively or dominantly on subsidized, income-based housing is advocating to perpetuate the housing crisis. ”

3. How NIMBYISM perpetuates segregation. Writing at Next City, Houston’s Chrishelle Palay describes how NIMBY arguments against new development are thinly veiled attempts to further enshrine segregation. She writes: “Sadly, NIMBY is the typical response to proposed affordable housing development in well-resourced communities. Neighborhoods that offer close proximity to high-performing schools, access to transit, employment centers and quality food choices typically lack affordable places to live — by design.” City government’s acquiesce to neighborhood opposition in these well-heeled communities–so little if any affordable housing gets built there. Meanwhile, similar proposals to build affordable housing in low income communities generates little political heat. The result: public housing dollars, small though they are, help recapitulate and reinforce the economic segregation of metro areas.

New ideas

1. Do jobs follow people, or people follow jobs? Richard Florida has a nice write-up at CityLab on a new study of the relationships between migration and job growth drawing on data from three Nordic countries. The big takeaway: for highly skilled jobs and creative class workers, the relationship is that jobs follow people. For less skilled work, the tendency is the opposite: people tend to migrate to where jobs are more plentiful. As Florida notes, this dynamic tends to accentuate the bifurcation of economic activity between prosperous, high skilled and higher cost knowledge-based cities, and lower cost, but less productive areas.

2. Student loan debt and young adult homeownership. Silda Nikaj of Texas Christian University and Jonathan Miller of HUD have compiled some interesting data on homeownership and student debt. They find a statistical connnection between the level of student debt and the likelhihood of being a homeowner: each 10 percent increase in student debt is associated with a .07 percent decrease in the homeownership rate for young adults. Homeownership is most likely to be depressed among those who didn’t finish a program of study or who attended a less selective college or university.