What City Observatory did this week

1. Kevin Bacon and Musical Chairs teach us housing economics. It’s an article of faith among economists that more housing, even higher end housing, will help ease rising rents. But to lay-people, that seems counterintuitive. A new paper from the Upjohn Institute shows that the construction of new housing creates a kind of chain-reaction of moves by households that propagates to housing in low income neighborhoods. When a household moves to a newly built, market-rate unit, they move out of the home they previously occupied–and the housheold moving into that unit frees up another unit, and so on. The Upjohn paper uses a detailed private database tracking changes of address to see exactly how moves into one unit create vacancies elsewhere. And like the famous game “Six Degrees of Kevin Bacon,” it turns out that just a few moves connect widely disparate neighborhoods. The paper estimates that building 100 units of new market rate housing generates 60 household moves into housing in low income neighborhoods.

2. Time to dig into the data to see whether ride-hailing leads to increased crashes. Last October, we took a skeptical review of a research paper from the University of Chicago, claiming to find a correlation between the advent of ride-hailing in particular cities and an increase in crash rates. In our view, the paper was based on crude data, and didn’t adequately control for the decline in gas prices and the related increase in driving. The gold standard, we argued, would be to exploit data on the time and location of ride-hailed trips, to see whether these correlated with places where crashes increased. At the time, no such data was available, but this month, the City of Chicago has published detailed data on ride-hailed trip making. Combined with the detailed data already available on crashes, there’s not reason to be making claims about crash rates based on indirect and highly aggregated measures. We’re calling for the Chicago researchers to take a closer look at this data.

3. What causes gentrification from A to Z*. There’s no shortage of people and things that get blamed for causing gentrification, and we’ve compiled a list from A to Z, from Artists to Zoning, that calls out the many suspects. There’s an asterisk here, because while many of these things are correlated with gentrification, it’s more likely that they are symptoms, rather than causes. In our view, you have to read to the very end of the list, to Y and Z, to get to the real causes. Y is you: It’s your demand for housing–whether you actually choose to live in a gentrifying neighborhood or not, that helps propel rents upward. And that demand (from you and others) bumps squarely into Z – Zoning. In most of our cities, we’ve use zoning and related land use requirements to essentially ban building the kind of dense, diverse mixed use, mixed income neighborhoods that we value most, and made it expensive or impossible to build new housing in the places that already have those characteristics. The result: rising rents in under-valued city neighborhoods that have the potential to achieve some level of urban quality.

Must read

1. Alex Baca on the vapid journalism on gentrification. Occasional City Observatory contributor Alex Baca has a commentary at Greater Greater Washington discussing the role of media coverage of gentrification. She notes a recent Washington Post article describing yet another study relating statistics on neighborhood level population change, which shows Washington has experienced some of the most “intense” gentrification of any large US city.” Baca’s point isn’t that this coverage is wrong, but that its just not enough: observing what’s happening, without coming up with something other than superficial reasons why, may generate clicks, but hardly constitutes useful journalism. She writes:

Our public conversation is not helped by writing about gentrification with some sort of wide-eyed wonderment, or with righteous indignation without substance. . . . Journalists should no longer simply highlight a study about gentrification while allowing root problems to go unexplained and responsible actors to continue unchallenged.

While her emphasis is specifically on Washington, DC, much the same could be said more broadly of most reporting on gentrification.

2. Translating Uber’s corporate filing into plain english. Ride-hailing giant Uber is rushing to follow Lyft in placing its public offering. In the process, investment disclosure laws require the company to offer the most detailed and forthright description of its financial results and future business plans. Much of this is written in a obscure dialect meaningful only to financial analysts and corporate securities experts. But helpfully, the Internet has provided a condensed translation, courtesy of Brad DeLong’s Grasping Reality with Both Hands, which we think fairly represents the company’s current and future prospects:

horsesatemymoney: “Abbreviated version of prospectus: We don’t make money. We probably will never make money. Our current business relies on shareholders to fund cheap cab rides in the hope that regulators will let us become a monopoly and charge whatever we want but the regulators are not playing along. We have therefore spent more money expanding into other low margin highly competitive activities like food delivery or trucking despite there being lots of specialist logistics firms so not obvious how we are going to make any money there either. We hope in the future there will be driverless cars and that we can then make money because no drivers but other people are developing them too. We have annoyed lots of regulators so we have lots of disputes and problems with regulators. We don’t pay much tax and have done lots of aggressive tax planning and so we have lots of disputes and problems with tax authorities. We don’t employ anyone (or we say we don’t) but we have lots of de facto employees and so we have lots of disputes and problems with drivers and employment tribunals. We don’t actually own many assets because we managed to get our drivers to provide their own cars. We have an app but other cab companies also have apps. Current investors want to get out and so we hope you will buy some shares anyway because you have heard of us. Also we need more money to fund the businesses that don’t make money. We are expanding into more business lines that don’t make money and we need more money to fund those. We are really big and you have heard of us plus we say we are a tech disruptor so don’t worry that we make no money it will all be great because you will be an Uber investor…

3. Is Portland’s Inclusionary Housing ordinance stifling housing investment? Just over two years ago, Portland’s inclusionary housing requirements, some of the most stringent in the nation went into effect. We and others predicted that they were likely to deter new residential construction, but that effect has been obscured by the land rush of building permit applications filed just before the new requirements took effect. Developers have been building those pre-inclusionary permitted units for the past two years, and there now signs that new investment is dwindling. In the past two years, private development under the inclusionary requirement has produced fewer than 350 units of affordable housing. A report from the Portland Daily Journal of Commerce notes that some developers report Portland is no longer profitable. Some projects are going forward–thanks in part to the fact that the City last year dialed back a scheduled increase in the inclusionary requirements. But rates of return are low enough that only local investors, committed to the Portland market, and willing to accept a lower profit are moving forward, while out of state investors stay away. Similarly, development seems to be moving forward only in the neighborhoods with the strongest demand, where profits from market rate units can cover the costs of building inclusionary units; in weaker neighborhoods, investors can’t make enough from the market units to make projects pencil out. These stories may also be the tip of the iceberg: as we’ve noted before at City Observatory, its nearly impossible to detect the housing units that aren’t built because investors have simply decided its not even worth investigating the market.

4. How the missing middle protects neighborhood character. Sightline Institute’s Michael Andersen has a terrific man-bites-dog housing story. While “neighborhood character” is often thinly veiled code for economic or racial bias, Andersen relates the story of a Portland resident Patty Wentz who wants to see more duplexes, triplexes and similar “missing middle” housing units built in her neighborhood, so that it retains (and perhaps restores) some of the vibrant socioeconomic diversity that it had when she first moved there. Rising housing costs have effectively selected against many households who would have like to live in the neighborhood, especially families with children. Andersen quotes Wentz’s testimony to the Oregon Legislature in favor the the legislation liberalizing missing middle housing.

We can open the possibility for young families, people of color and seniors on a fixed income to join us on our beautiful tree-lined streets close to good schools within blocks of some of the most beautiful public parks in the country. We can start to address racially discriminatory policies that historically kept people of color out of our neighborhoods. Once again allowing a few new duplexes, tri-plexes and four-plexes on single lots on my block with HB 2001 will do more to help people than any charitable contribution I can make, any march or rally I go to or any volunteer activities I can do.

New Knowledge

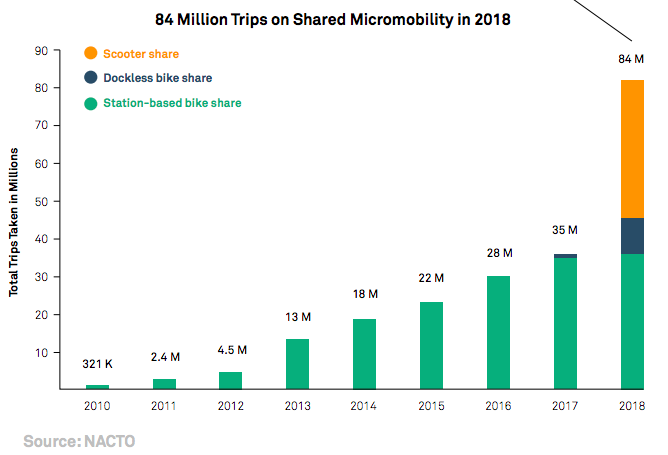

NACTO report on the growth of shared micromobility. Add a new term to your transportation statistics lexicon, and get ready to see in more frequently. The National Association of City Transportation Officials (NACTO) reports on the explosive growth of “shared micro-mobility”–think shared electric scooters, and docked and dockless shared bikes and e-bikes. Combined, these modes provided more than 84 million trips in 2018, double the number of 2017, due primarily to the introduction of shared e-scooters from Bird, Lime and others.

The report, compiled from data gathered chiefly from NACTO cities, sheds considerable light on the kinds and locations of travel by different modes. Monthly subscribers to shared bikes tend to use them mostly for peak hour, weekday trips, while shared e-scooters tend to be relatively more popular for midday, evening and weekend use. These data suggest that different modes and pricing structures will serve different travel demands. The rapid growth of scooters signals that there’s a rich latent demand for alternative forms of urban mobility.

In the News

Strong Towns re-published Joe Cortright’s commentary about the Ben and Jerry’s annual advanced transportation seminar, demonstrating that charging a zero price for something valuable leads to congestion.

Market Urbanism’s Emily Hamilton cited our essay on the fundamental contradiction between our twin goals of promoting housing affordability and encouraging home ownership as an investment in her analysis of Senator Elizabeth Warren’s latest housing policy proposal.