What City Observatory did this week

1. Don’t demonize cars, just stop subsidizing them. Is there anything in the urban space that is more inflamed than the passion and rhetoric around cars and driving? Advocates on both sides are bitter and uncompromising: with cars (and their parking spaces) regarded as either a fundamental right or an existential threat. Finding a middle ground for compromise isn’t easy, but we suggest a starting place: stop subsidizing car ownership and use. From un-priced and under-priced roads, to a wide range of public subsidies to cover the injuries and environmental and health damage done by cars, to the prodigious subsidy in the form of urban space devoted to parking and the hidden cost of parking requirements, we essentially pay untold billions of dollars to people to drive more than makes economic sense. If we ended all these subsidies, people would make different and much better choices about whether to own cars, and how much, and when and where to use them. Inviting car users to pay the full-cost associated with their choices is a much more plausible way forward than simply demonizing vehicles.

2. What a cohesive community looks like. In a guest post for City Observatory, Em Friedenberg talks about her studies of the connections between features of the built environment and social trust. There’s a palpable difference between the streetscapes and urban form of many older, European cities and the contemporary US urban space. The former have higher density, a greater mix of uses, and much more conscious investment in the public realm, that both support and encourage greater social interaction. Friedenberg has a poster cleverly illustrating twenty urban design features that cities should employ to promote better, more interactive public environments.

3. How luxury housing becomes affordable. It’s one of the most widely repeated talking points of housing activists: “new housing just isn’t affordable for low and moderate income households.” The implication is that there was once a time when lots of inexpensive new housing did get built for the lower half of the income distribution–but that’s not how housing markets work. It’s almost always the case that new housing gets purchased and occupied initially by higher income households, and as it ages and depreciates, it moves down market. The affordable housing of today is chiefly the market rate housing built in the 1970s and earlier. Affordability problems arise when we don’t build enough new high end, market rate housing, prompting higher income families to hang on to and bid up the price of the older housing stock that would otherwise become available for households of more modest means.

Must read

1. Much new technology is really urban technology. Richard Florida sifts through the data on global venture capital investment trends and concludes that much of the new technology that’s being developed is really revolves around urban living. Whether its Uber and Lyft implementing ride-hailing, or e-bike and scooter companies, or firms looking to disrupt housing markets (like Air BnB), much of the investment is aimed at the urban space. Given that a growing share of the world’s population and economic activity are concentrated in cities, this hardly seems surprising: urban areas are where the market is.

2. How public policy tilts toward homeowners and against renters. Brookings Institution’s Jenny Schuetz has a primer on the fundamental and pervasive ways in which the combination of federal, state and local laws, regulations and tax policies tilt decisively in favor of homeownership (particularly by higher income households) and work against renters (who on average have much lower wealth and income. Whether its restrictive local zoning that drives up rents and home prices, state homestead exemptions that reward property owners but not renters, or key provisions of the federal tax code, especially the favored treatment of capital gains from housing, and the mortgage interest deduction, there’s little question that renters get far less help than homeowners.

3. A Pedestrian Bill of Rights. With considerable help from the Twitterverse, Transportist blogger David Levinson has compiled draft 0.1 of a Pedestrian Bill of Rights. It’s a thought-provoking read, and a reminder of how many of the “rules of the road” have been written (or interpreted over time) to privilege auto-travel over the most basic and universal form of human transport–walking. There are 15 articles in the bill of rights, and the first three give you a good flavor for what’s on offer.

- Pedestrians have the right to safely and conveniently walk along and cross any public right-of-way without regards to who they are, with whom they are associating, when or why they are traveling, or where they are coming from or going to. #NoPoliceStops

- In the event of a conflict with vehicles, pedestrians automatically have the right-of-way. Where no dedicated footpaths are available, any pedestrians have the right-of-way over any other traffic and speeds shall be limited to that traveled by those pedestrians. Pedestrians shall never be required to give way to self-driving vehicles. #Right-of-Way #Footpaths #SharedSpace #StopForNoBot

- Any pedestrian may cross roads at any point at any time where they will endanger neither themselves nor others by doing so. #JaywalkingIsNotACrime.

Hopefully, this is just the start of the conversation. With the likely advent of driverless vehicles in the next few years, it’s a very good time to revisit these fundamental questions about who has what rights when it comes to using the common streetscape.

New Knowledge

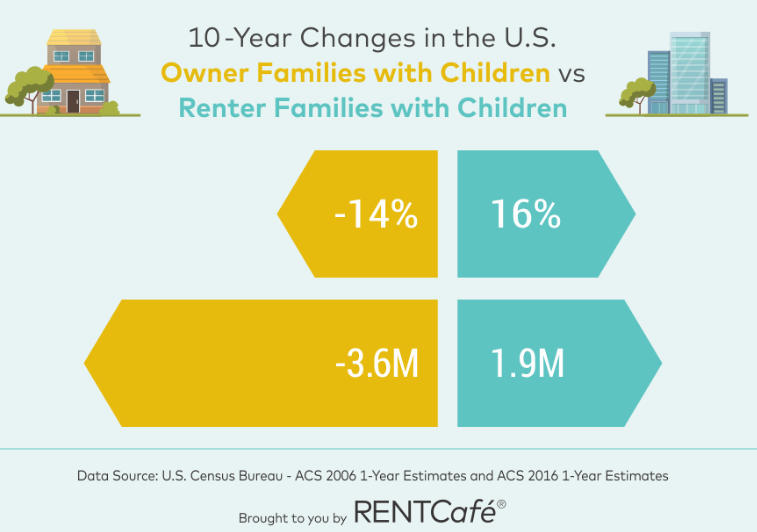

The declining number of homeowners with children. The stereotypical view of homeowning households as being nuclear families with a couple of parents and kids is increasingly out of date. As we’ve noted a City Observatory, homeownership is now increasingly concentrated among much older Americans (with the only net increase in homeownership occurring for households 55 and older). The flip side of that trend is fewer and fewer home-owning households with kids. The analysts at RentCafe have run the numbers on this and find that the US has 3.6 million fewer households with children 18 and younger living at home than a decade ago.

There’s been a sharp increase in the number of families with kids who rent (up 16%) and now its the case that homeowners are less likely to have kids living at home than renters. As RentCafe’s Nadia Bolint explains:

There’s been a sharp increase in the number of families with kids who rent (up 16%) and now its the case that homeowners are less likely to have kids living at home than renters. As RentCafe’s Nadia Bolint explains:

As of 2016 (the most current Census estimates), 14.3 million households with minor children rent in the U.S. (up from 12.4 million in 2006), representing 33% of all renter households. By comparison, there are 22.1 million families with minor children that own their home (down from 25.7 million in 2006), representing 29% of owner households.