The greatest urban myth of the Covid-19 pandemic is that fear of density has triggered an exodus from cities.

The latest data show an increase in interest in dense urban locations.

At City Observatory, we’ve regularly challenged two widely repeated myths about the Corona Virus. The first is that urban density is a cause of Covid-19, and the second, and closely related, is a claim that fear of density in a pandemic era is sending people streaming to the suburbs and beyond.

Our recent report, Youth Movement, confirmed the depth and breadth of the long-term trend of well-educated adults moving in large numbers to close-in urban neighborhoods. And the real-time data from real estate market search activity confirmed that cities were still highly attractive, gaining market share in total search activity from suburbs and more rural areas, according to data gathered in April by Zillow and Apartment List.com

Now, with even more data in hand, the picture remains very much the same. Apartment List.com economists Rob Warnock and Chris Salviati have done a thorough analysis comparing the pattern of apartment search activity in the nation’s 50 largest metro areas between the first and second quarters of 2020; basically the period just before the pandemic struck with full force, and then the three months during which much of America was reeling from the virus and stuck in lock-down, with lots of time to consider possible new living locations.

Bottom line: As revealed by apartment search activity, interest in cities actually increased in the second quarter compared to the first, relative to other locations, including suburbs, other less dense cities, and rural areas.

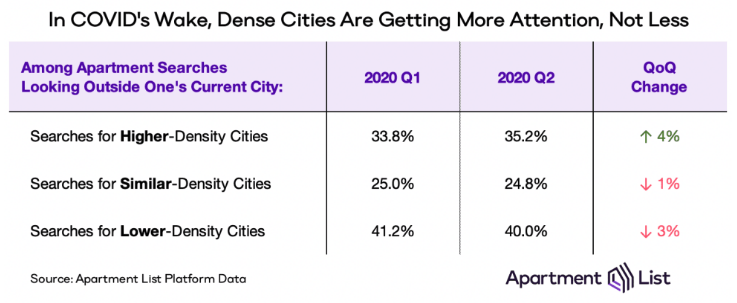

Overall, apartment search activity is up in the second quarter: More people are looking to move (or perhaps sheltering in place has given us all a lot more time to spend on the computer, and therefore gives more people more time to look at new places). Either way, the ApartmentList data don’t show any flight from density. Warnock and Salviati looked to see whether people were looking to move to a higher density city, a lower density city, or a city with about the same density. Nationally, they found that the share of searches for apartments in cities with higher density than one’s current residence grew about four percent, while the share of searches in similar or lower density cities actually declined.

Overall, the data undercut the idea that density considerations are reshaping the demand for apartments. They conclude:

But even if renters are a bit more likely to search in new locations, they are not eschewing density. In anything, we actually see a slightly greater appetite for density than we did prior to the pandemic. Among users searching beyond their current city in Q2, just over 35 percent are looking for homes in a city with higher population density than where they currently live, a 4 percent increase quarter-over-quarter. Despite density’s bad reputation recently, searches to lower-density cities have actually ticked down 3 percent quarter-over-quarter.

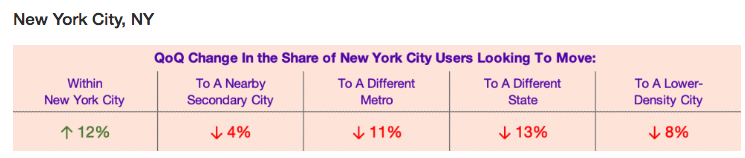

Helpfully, Apartment List.com provides detailed data for the 50 largest markets, so we can see how this plays out in different parts of the country. Its especially interesting to look at the New York City metro area. For the first months of the pandemic, it was the epicenter, with rates of new reported cases far higher than in the rest of the country. (The fact that Covid-19 hit metro NYC so hard and so early is undoubtedly one reason that some leaped to equate density with viral risk). ApartmentList.com’s data show that searches by those living in New York City for apartments in the city increased, relative to searches elsewhere; meanwhile for those looking at the New York City metro area, the share of searches for apartments in the five boroughs actually increased relative to the rest of the metro area. Between the first and second quarters of 2020; the share of searches by NYC residents within the five boroughs was up 12 percent, the share of searches outside the city, whether to a outlying suburb, a different metro or different state, or to a lower density metro all declined.

The findings are the exact opposite of what one would expect if the headlines about an urban exodus were correct. Rather than looking to less dense suburbs, or exploring other states, apartment search activity is focusing more on dense city locations:

While stories of Americans abandoning cities proliferate, our search data present a far more nuanced account of COVID-19’s impact on housing choice. Since the start of the pandemic, users have, on the whole, become slightly more likely to search in cities with higher population density than where they currently live. Similarly, searches from suburbs to core cities have become more common, rather than the other way around.

While the New York pattern holds for most metro areas, there are a handful of cities that are seeing a decline in central city search activity, but as Warnock and Salviati point out, there are local factors in each case that likely explain these trends. Boston has seen a decline in central city search share relative to suburbs, as has San Francisco and Chicago. In San Francisco, high housing costs coupled with increased remote working opportunities may have blunted demand, but that has mostly shifted to nearby markets like Oakland and Berkeley. In Boston’s case, the softening of housing markets may be related to declining demand from college students, who make up a disproportionate share of renters and who are facing extreme uncertainty about school schedules.

As we’ve pointed out, irrational fears about the negative health effects of urban living have a long history in the US. The “teeming tenements” view of cities underlies many of the misleading anecdote fueled stories about people leaving cities. But the hard data show that suburbs and sprawling sunbelt cities are just as vulnerable to the Coronavirus, and while poverty and housing overcrowding are risk factors, there’s nothing about urban density itself that intensifies the spread of the disease.