One of the enduring features of American inequality is the wide disparity in homeownership rates between white Americans and Latinos and African-Americans. And because homeownership has — or at least was, historically — a principal means by which families built wealth, this disparity in homeownership translated into or amplified racial and ethnic wealth disparities. There are, of course, many reasons for the disparities in homeownership rates: discrimination in home sales, employment, and education figure as prominent explanations, as does red-lining and exploitative lending practices.

This observation seemingly leads to a straight-forward policy response: if we want to redress our wealth disparity, we ought to be promoting wider homeownership, especially for racial and ethnic groups, like Latinos and African-Americans. And because access to housing finance is central to ownership, that leads to proposals to liberalize or loosen up lending standards. That’s exactly the case that was made recently by the Urban Institute, which said:

For a full mortgage market recovery, we need to expand the credit box again. A number of reforms can be undertaken to encourage lending to creditworthy borrowers who would have qualified before the housing boom. A return to 2005 and 2006 lending practices would be ill-fated, but the pendulum has unquestionably swung too far. Today’s tight standards have locked out many prospective borrowers from homeownership, disproportionately preventing African American and Hispanic families from building wealth and benefiting from the recovery.

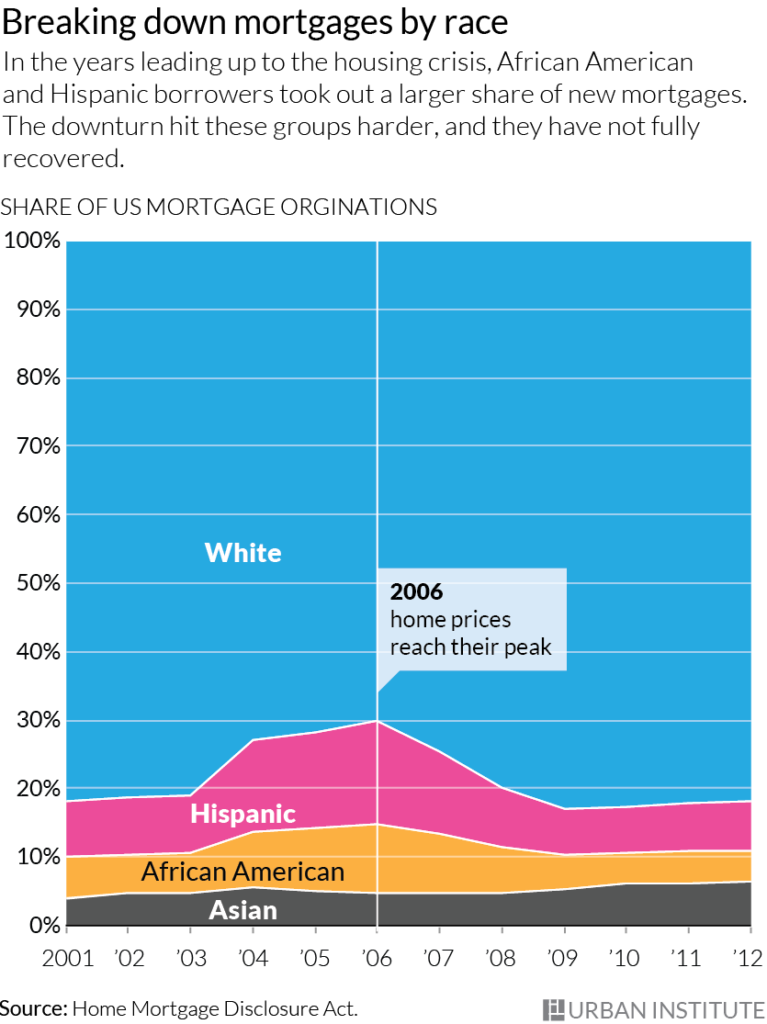

The Urban Institute provides copious details on the patterns of mortgage lending, by race and ethnicity over the past decade and a half (with very cool mapping, both nationally and by metropolitan areas). They show that since 2006, mortgage lending to African-Americans and Latinos, as a share of all mortgage originations has fallen sharply.

But would loosening mortgage restrictions and opening up housing finance really result in economic gains to those now shut out of the housing market? Perhaps the most fundamental advice in investing (and the hardest to follow in practice) is “Buy low, sell high.” In a technical sense, this is referred to as “market timing.”

The big lesson of the housing bubble and subsequent bust is that market timing matters a lot to investment results. If you bought your home in 2000 (or better yet, sometime in the previous decade), you not only saw big gains in the bubble, but you probably came out the other side with your head (and your mortgage) above water. But if you bought at the peak of the bubble, in 2005 or 2006, and especially if you purchased your home with a highly leveraged 90 or 95 percent mortgage (as many did) you saw your investment wiped out–and more.

And as the Urban Institute data make clear, the groups most likely to end up in this wealth destroying “buy high, sell low” situation are Latinos and African Americans: “African American and Hispanic borrowers took out a greater share of mortgages as housing prices neared their peak, arguably the worst time to take out a loan.” In 2001, when we were in a recession and house prices (by standards of that decade) were low, these groups made up just 13 percent of all new home mortgages. When lending standards loosened up, the share of minority borrowers surged, and in 2006, African-Americans and Latinos made up almost twice as big a share (23 percent) of new mortgages. And then, as the bubble collapsed, and lending standards tightened, they were again squeezed out of the mortgage market.

As we’ve noted before at City Observatory, rotten market timing is just one of the problems confronting minority borrowers. In addition, they tend to be charged higher interest rates (typically because they have lower credit scores), they tend to buy in neighborhoods with greater volatility and downside risk, and were–as several billion dollar plus settlements attest–victimized by exploitative lending practices.

From the standpoint of policy, and trying to tackle this persistent wealth gap, the question going forward is whether housing investment in the future will out-perform other investments. Plus, as we’ve pointed out, there’s an inherent tension between treating housing as a wealth-building policy and achieving housing affordability. While relaxing lending standards further (and allowing borrowers to take on greater leverage) might help more Latino and African-American families buy homes, its far from clear than its a strategy that will enable them to build wealth. It would be great if housing purchases were a risk-free investment that would guarantee a reasonable rate of return, and if all borrowers had the same opportunity to buy at the same terms and at the same times. But that’s not the way the housing market works, even–or especially–when lending standards are relaxed. If we want to redress the big gaps in wealth among racial and ethnic groups in the US, we’ll probably need to consider other policies to do so.