Pay no attention to Zumper’s claims about rent trends

Zumper claims rents for one-bedroom and two-bedroom apartments are moving in opposite directions in about a fifth of all markets

There’s a lot of hyperventilation in the media about falling rents in different places in the US. It’s certainly likely that in the midst of the worst and most abrupt economic downturn in more than a century, and now, with the expiration of expanded unemployment insurance benefits that we’d see some downward pressure on rents.

If Zumper’s data is to be believed, rents are collapsing in San Francisco and New York (down 11 and 7 percent, respectively) and exploding in Cleveland, Columbus, St. Louis, Indianapolis and Detroit (all up more than 14 percent year over year). But the wild fluctuations across markets should immediately raise questions about how these data are calculated.

But please, oh, please, do not look to the Zumper real estate data to tell you anything meaningful about what’s happening. We’ve been over this before, several times. Zumper aggregates listings of current rentals from various sources and reports on the median asking rents at any moment in a city. The trouble with this methodology, as we’ve pointed out, is that its highly susceptible to “composition effects.” If a new building is completed in a city and adds 100 or 200 high priced apartments to the mix in the marketplace, Zumper treats this as an increase in rents. If low priced apartments rent quickly and high priced ones linger on the market, this too drives up the apparent rent–but not because rents have gone up market-wide, but only because the composition of “for lease” apartments has changed. The same thing works in reverse as higher value units get rented–they drop out of the for lease category, and aren’t counted, so it appears that the rents in the pool of available apartments has gone down.

Because there are constant shifts in the set of apartments that are for lease at any one time, Zumper’s method really is measuring that shift in composition, rather than changes in market prices.

There’s plenty of evidence from Zumper’s own data to show how erratic and non-sensical its measures are. Zumper separately reports prices for one-bedroom and two-bedroom apartments. In general, when rents are rising (or falling) in a market, one would expect these two measures to move synchronously (i.e. rising or falling by about the same amount, especially over longer periods, like a year). But Zumper’s data show little correlation between year over year trends in one-bedroom and two-bedroom apartments.

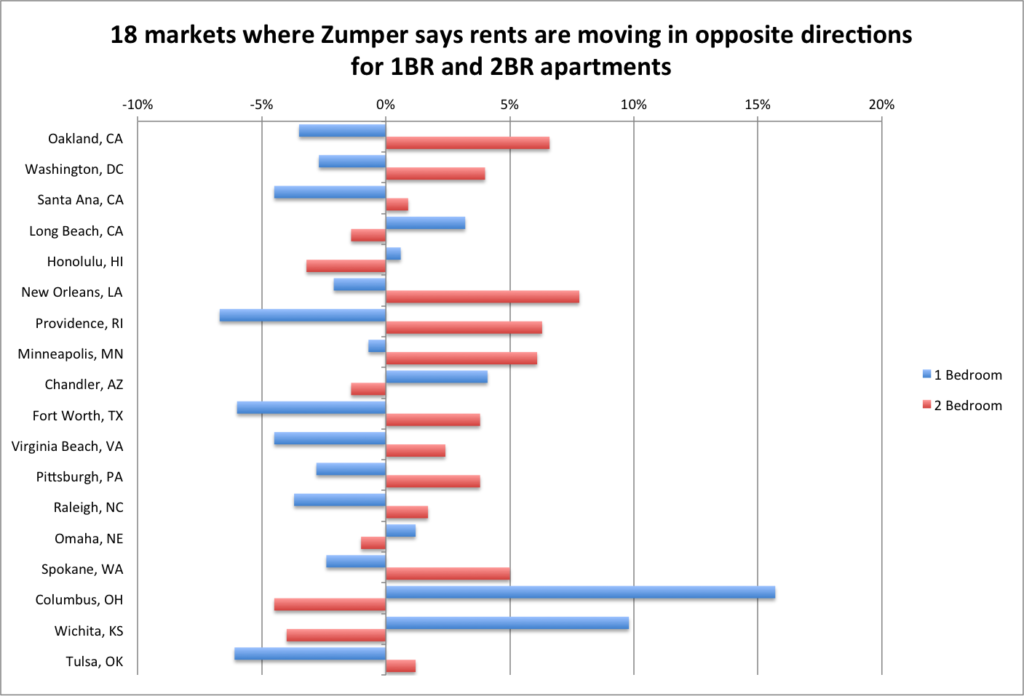

The clearest indicator of Zumper’s craziness is that in 18 of the 100 markets for which it reports data, the price trends for one-bedroom and two-bedroom apartments are moving in opposite directions over the last 12 months. For example, in Oakland, California, Zumper says rents for one-bedroom apartments fell by 3.5 percent, while rents for two-bedroom apartments went up by 6.6 percent. That’s a ten percentage point difference in the price trajectory of the larger and smaller apartments. The same pattern of increased rents in one category and decreases in the other holds for Washington, Minneapolis, New Orleans, Pittsburgh, Raleigh, Columbus and a dozen other markets.

In these 18 markets, the absolute value of the difference in reported rent changes between one- and two-bedroom apartments is not small: it averages more than 8 percent, which is larger than the typical year-over-year change within categories for these markets. The big variance in rent trends between one- and two-bedroom apartments within a market is a pretty clear indication that Zumper’s method is biased by these composition effects.

Okay, business journalists, we get it. Someone sends you a press release with a ream of data (with decimal points!) that ranks US cities. You don’t have the time to look into their methodology, you’ve got a deadline. But you can do much better than this. Other sources of data (we like Zillow and ApartmentList.Com) report much better behaved data based on much more transparent methodologies. If you care about understanding what’s really happening in real estate markets, don’t rely on Zumper.