You won’t know that your inclusionary zoning program is wrecking the housing market until it’s too late to fix.

How lags and game theory monkey wrench inclusionary zoning.

One of the toughest problems in economics and economic forecasting is dealing with markets and decisions that involve considerable lags. There’s often a lag, or length of time between the time an economic actor recognizes a changed circumstance and the time that anything they do will act upon it. The Federal Reserve Board is always trying to anticipate future conditions in the economy (incipient inflation or a potential recession) because it knows any policy action it takes will require several months to influence the larger economy.

Lags are an especially important problem with investment decisions. Investments, particularly those involving new construction, often involve significant lags. In the housing market, for example, it can take a couple of years between the time a developer identifies a potential market, and goes through all the steps of searching for and buying property, developing plans, submitting plans for government approval, lining up financing, hiring a construction firm, and actually building something. A key cause of the run up in rental prices in many cities was this lag, or what we might technically call the “temporal mismatch” between demand (which changed quickly) and supply (which took several years to respond).

Lags can also play out in the economic data–sometimes the negative effects of some policy don’t show up right away–it can take months or years before the effect of some decisions are apparent–and by then, it can be too late to do anything to correct the underlying problem. You can call this the Wile E. Coyote problem.

As you know from the Warner Brothers cartoon, the Coyote can go wildly charging off a cliff, and keep going forward for some time before he looks down, and then discovers there’s no longer any ground beneath him.

The open question right now is whether the City of Portland’s housing market is in its Wylie Coyote phase. To hear the City of Portland housing bureau tell the story, everything is fine: Housing permit activity is chugging along at relatively high levels.

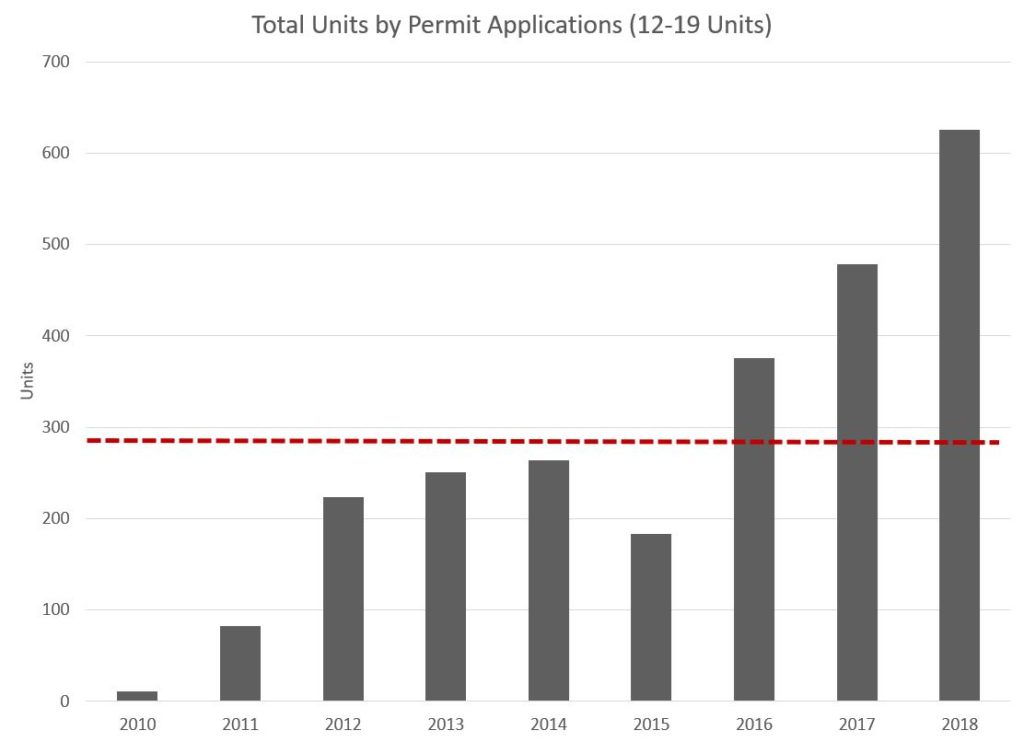

But what this misses is that the pipeline to produce housing is a long one, and there’s abundant evidence that its drying up. While there was a surge of housing proposed to beat the city’s deadline for complying with new inclusionary housing rules (February 1, 2017); since then, new proposals have slowed sharply.

Portland’s Daily Journal of Commerce reports that a number of developers say that apartment projects in Portland no longer provide an adequate rate of return to attract financing:

Inclusionary housing pushes the return on costs below a level that is really acceptable to capital markets,” said Brian Wilson, a partner with Mainland NW. “It is very difficult to underwrite them even in the best of circumstances.” Mainland has planned to develop several properties in the Cathedral Park neighborhood of North Portland, but the developer has been unable to raise adequate equity, Wilson said.

The housing industry group Up for Growth has tabulated figures on proposed new development and concludes that there’s been a significant drop off in proposed construction. They also report a substantial up-tick in proposed new apartment developments smaller than 20 units (to which the city’s inclusionary zoning requirements don’t apply). That signals developers are actively seeking to avoid the requirements, and (unfortunately for the city’s housing supply) may be under-building on some sites that could accomodate more housing.

For now, city officials appear to be in denial that anything’s amiss. But there are some cracks in that optimistic facade. As originally adopted the city’s inclusionary zoning ordinance provided for a step-up in the inclusionary set asides. In the first year of the program, developers were required to set aside 8 percent of units for households of 60 percent or less of Area Median Income (AMI) or 16 percent of units for households at 80 percent of AMI. After the first year, that was scheduled to step up to 10 percent and 20 percent respectively. But the city backed off implementing that requirement. Why, if the inclusionary zoning program was working as planned, did the city drop those requirements?

It’s a sign that the city isn’t particularly comfortable with its claims of success.

More alarmingly, the situation the city now finds itself in, is in many ways problematic, for reasons suggested by game theory.

Game theory and inclusionary zoning

Game theory studies how people respond to incentives. One well-known game theoretic workhorse, for example, is the prisoner’s dilemma, which considers the incentives a criminal co-conspirator has to to turn state’s evidence against and accomplice in return for a lighter sentence.

Game theory is important to policy, particularly when it comes to the timing of investment. The prospect of changes in the rules often shapes behavior. Changes in the tax rates of capital gains, for example, can prompt investors to do things differently (leading to an uptick in sales before increases in tax rates, or a deferral in sales until after tax cuts take effect).

We can think of apartment developers and investors as playing in a housing game. One part of the “rules” of that game are the city of Portland’s land use planning process, and the players in this game will keep a close eye on possible future rule changes in deciding whether, and when, to invest in Portland.

The advent of new land use planning requirements, like Portland’s inclusionary zoning requirements, adopted in December 2016, but which took effect in February 2017, are subject to just this kind of game theoretic effects. The city’s adopted ordinance projects that filed after February 1 to set aside a portion of newly constructed units for low and moderate income families. Projects that filed for land use approval before the law went into effect were exempt.

Unsurprisingly, there was a land rush of developers to file under the older, laxer rules.

From a policy standpoint, that was a huge plus, at least in the short run. Despite concerns that the cost of complying with the IZ requirement would reduce apartment investment, any negative effect has, at least so far, been more than offset by the flood of new development approval applications.

So the first two years of inclusionary zoning in Portland have been a game-theory win-win for housing affordability. The threat of tougher future requirements prompted a whole lot of investment to happen much earlier than it otherwise would have, and new developments, added to those already under construction, have helped deliver a lot more new apartments in Portland. That came at a good time, and has clearly helped with affordability– vacancies have ticked upward, and rents have leveled off and even declined. Yardi Matrix says that rent increases in Portland in the past 12 months were lower than in 19 of the 20 largest metro markets–a huge reversal from just four years ago, when Portland rents were increasing faster than almost any other market in the US.

As everyone acknowledges, though, that one-time surge in applications is just temporary. As those projects get built, its increasingly apparent that very little new development is following in its wake. There’s credible evidence that development is slowing because the IZ requirements dramatically reduce the attractiveness of new apartment investment in Portland.And now is when the game theoretic aspects of the policy process come back to bite the city and threaten housing affordability.

So here’s the game theory problem: If (as we believe) the IZ requirements are stifling development, what does the city do? Broadly speaking, it has two choices: It can “stay the course” and maintain the adopted IZ requirements, or it can lessen them.

If it pursues option one and signals it’s going to stay the course, it probably just prolongs the pain. If investors are convinced that Portland would stay the case no matter what, they’d probably adapt to the new regime–some would move forward with their plans, many would likely leave the market. As several developers have noted, the market will rebound when the shortage becomes so severe that rents rise enough to offset the costs of complying with the IZ ordinance–which will mean that the IZ policy will have failed in its primary objective to make housing more affordable.

Option 2 may ease the pain of the IZ requirements, but potentially comes at a price. If the city signals it’s considering relaxing or adjusting the requirements, that would likely have the perverse effect of encouraging investors to wait and see, at least until new rules are adopted. Why move ahead with a project under expensive or burdensome IZ regulations now, when, if you wait a little while, you might get a much more favorable deal? A prolonged debate over whether to walk back its IZ requirements could further dry up the development pipeline.

This puts city officials in an difficult policy bind: They can stick belligerently to their beliefs that they’ll execute the law, even if it has adverse consequences (which may provide some certainty) , or if it actively entertains doubt and floats the possibility of liberalization or relaxation of requirements, unless it acts to implement them immediately or abruptly, it invites investors to postpone any plans to work in Portland.

Option 2 effectively constitutes the city’s “Wile E. Coyote” moment: when it looks down and sees no ground holding up its IZ policy, things will start falling, fast.

As a result, we’re quickly moving from the “can’t lose” to “can’t win” portion of the housing affordability policy game. It will be interesting to see how the city responds.