A new study from Germany shows that added housing supply lowers rents across the board

A 1 percent increase in housing is associated with a 0.4 to 0.7 percent decrease in rents

Housing policy debates are tortured by the widespread disbelief that supply and demand operate in the market for housing. In our view, its been a growing demand for cities and urban living, running headlong into a relatively fixed, or at best slowly growing supply of urban housing that’s been the principle reason for affordability problems in many cities. But many housing advocates refuse to believe that increasing housing supply will have any beneficial effect on rents.

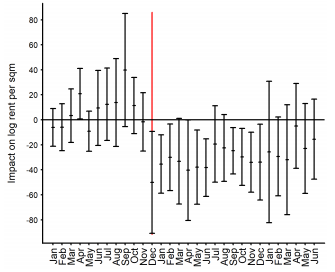

A new study from Andreas Mense an economist at the University of Erlangen-Nuremberg, using detailed data on housing construction and rents in Germany, documents the direct and widespread effects of new market rate construction on rent levels. The paper uses variations in the completion rates of new housing units over time to tease out the effects of increments to supply on rent levels. Here’s a typical chart showing how rent increases vary in response to additional housing completions in the month of December (the red line on the chart). In the wake of completions (the period to the right of the red line) rent changes are negative. The core finding is that a one percent increase in housing completions tends to be associated with a 0.4 percent to 0.7 percent decrease in rents.

Importantly, Mense’s work shows that added supply influences rents across the entire housing market. At best, market-skeptics will aver that new market rate units will reduce rents at the top-end of the market, but can’t conceive of how that will affect lower rent units. But Mense’s work shows that it isn’t just high end rents that decline.

To the contrary, they suggest that new housing supply shifts the rent distribution as a whole. When considering the point estimates, it seems that the lower parts of the rent distribution reacted more strongly in the first months after the new units came on the market, while the upper part reacted more strongly several months later. Overall, none of the two main forces — substitutability of housing units, and moving costs —, seems to dominate. The key implication is that new housing supply provided by private developers effectively lowers rents throughout the rent distribution, shortly after the new units are completed.

(emphasis added)

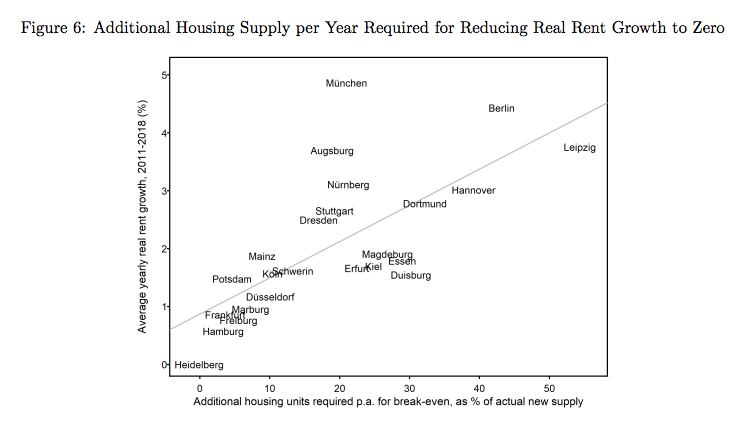

One of the most helpful aspects of Mense’s paper is that it has quantitative estimates of how much additional housing a city might need to build to stave off rent increases. For example, he estimates that Munich would need to increase the number of new units built over the past seven years by about 20 percent above the actually completed levels in order to hold rent increases to zero. Berlin, where markets are tighter and rent increases greater, would need an even bigger increase in production; most German cities would need to produce about 10-20 percent more new housing units than they actually built to hold rent inflation in check. (Note that the required increase is not a 10-20 percent increase in total housing stock, but a 10-20 percent increase in the number of new units built compared to actual new construction).

One of the most common objections to “supply side” approaches to promoting affordability is that somehow building market rate housing only affects the price of higher priced housing. This paper adds to a growing body of evidence that new market rate construction triggers a chain-reaction of moves and price adjustments that rapidly propagate through an entire housing market and ultimately benefit low income households. Building new housing sets of a chain of moves—the kind of musical chairs progression modeled by the Upjohn Institute’s Evan Mast—that yield increases in supply in existing units with various prices elsewhere in the region. The vacancy of these units not only creates additional housing opportunities at lower price points, but puts downward pressure on rents.

Housing costs of the population as a whole can be reduced effectively by letting developers provide enough market-rate housing. Consequently, denser development has great potential to reduce the housing cost burden of low-income households—in addition to other possible benefits such as shorter commuting distances and larger productivity spillovers.

This is an important finding for housing policy. Too much of the housing debate is a kind of myopic particularism, looking at whether a single housing unit is affordable, with no attention given to affordability across the market spectrum. Too often, policies are obsessed with highly visible but microscopically small interventions, which may provide affordability for a few lucky tenants, but which do little or nothing to lower costs and increase affordability across the entire housing market. The truly pernicious part of some strategies, like inclusionary housing requirements, is that the negative effects of such requirements on new housing supply (which operate across an entire market) outweigh the benefits in terms of a few dedicated affordable units. Ultimately, housing affordability is about scale, and increasing housing supply is a necessary precondition to making sure affordability is achieved for many, rather than just a few.

Mense, Andreas (2020). The Impact of New Housing Supply on the Distribution of Rents, Beiträge zur Jahrestagung des Vereins für Socialpolitik 2020: Gender Economics, ZBW – Leibniz Information Centre for Economics, Kiel, Hamburg