We shouldn’t expect the return of the trade-up buyer anytime soon.

Is the American homebuyer increasingly stuck in a starter home? That’s the premise of a recent commentary from the Urban Institute “Do we have a generation stuck in starter homes?” Looking at data on the share of home mortgages going to first time home buyers as opposed to repeat buyers, the Urban Institute’s Laurie Goodman, Sheryl Pardo and Bing Bai show, quite persuasively, that since 2008, a smaller and smaller share of home sales are accounted for by repeat purchasers (i.e. a household that already owned a home, and is buying a new home.) In 2015, there were only about 900,000 repeat homebuyers, compared to more than 1.8 million in 2001.

While the facts presented here strike us as exactly correct, we’re having a hard time signing on to the interpretation that’s offered. Its far from clear that we should want or expect their to be lots more repeat or trade-up home buyers. For the most part, the dominance of trade-up buying was a symptom of last decade’s tragic and un-sustainable housing bubble.

For a moment, let’s step back and think about the logic that’s implied here: the notion is that first time homebuyers buy a small home that they can afford and that over some period of time it appreciates – i.e. in real terms, over and above the rate of inflation – so that the homeowners can now take their increased equity (and perhaps add it to a higher level of household income) and “trade up” to a larger home or a nicer neighborhood. As Goodman and her co-authors explain:

The basic strategy for moving up from a starter home to a bigger home, however, has been to accumulate equity in the home through consistent price appreciation, and convert that equity into the down payment for a more expensive home.

That was certainly a big explanation for the housing market dynamics of the early 2000s. Thanks to rapidly rising home prices, homeowners found themselves awash in equity. And there were two other factors at work as well: First interest rates were dropping. From 2000 to 2006 the average interest rate on a thirty year mortgage fell from more than 8 percent to less than 6 percent. Lower rates mean—in a straightforward way—that one can buy more house for the same payment. At the same time, as is well-known, private sector lenders offered a range of “sub-prime” loans with lower but floating interest rates, and non-amortizing features.

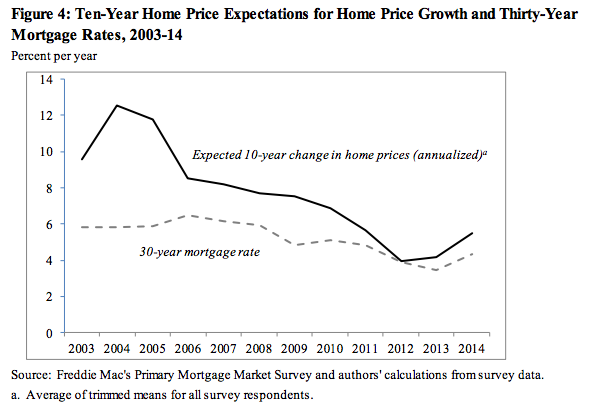

The other thing to keep in mind, (silly as it seems now, in retrospect) was the nearly universal belief among consumers that home prices could only go up. So, in effect, existing homeowners had a bonus in terms of rising equity, more purchasing power thanks to declining mortgage rates, and the expectation that the financially smart thing to do was double down in the housing market. All this was amplified by reckless lending policies by many financial institutions. Nobel Laureate Robert Shiller has underscored the importance of price expectations in driving the bubble—and they were certainly a key factor in enabling and incentivizing homeowners to “trade up” in the hot housing market. At the height of the housing boom, home price expectations greatly exceeded mortgage interest rates: so to buyers homes looked “free”: appreciation more than offset the cost of interest payments.

Little wonder that so much of the market activity in the bubble years was propelled by repeat borrowers. But actual and expected home price inflation came crashing earthward in 2006 and 2007 and suddenly the demand for homes collapsed. Karl Case, Robert Shiller and Ann Thompson illustrated this in their paper “What have they been thinking? Home buyer behavior in hot and cold markets.

There’s little sign that anyone expects home price appreciation to accelerate anytime soon. The Federal Reserve Bank of New York annually surveys a representative sample of consumers nationally about their five-year expectations for home price inflation; that number has declined by a third over the past two years from 3.01 per cent in 2014 to 1.89 percent in 2016

But there’s little reason that we should regard sustained home price appreciation that leads large numbers of homeowners to repeatedly “trade up” as a normal condition of housing markets, or, given changed circumstances any thing that is likely to recur any time soon. Nor should we wish or expect that to happen. As the collapse of the last bubble showed, that kind of growth isn’t sustainable. And as we’ve pointed out at City Observatory, sustained house price appreciation runs counter to our interests in promoting housing affordability.

Fretting that today’s generation of first time home-buyers—who are generally wealthier and have higher incomes than their home-renting peers of the same age—are somehow stuck in “starter homes” because they’re not “trading up” at the same pace as their predecessors were at the height of the housing bubble seems like one of the smaller problems facing U.S. housing policy, if it is a problem at all. Our attention and policy concern might better be directed to the situation of millions of renters who are facing steadily higher housing costs.

.