The most basic concept in economics is that higher prices lead to less consumption, yet this fact is routinely ignored in transportation planning and policy.

If we got the prices right, many of our most pressing transportation problems would be much easier to tackle

If we have too much of some things, and not enough of others, its a pretty good indication that the prices are wrong. We have, for example, too much traffic at peak hours in most of the nation’s cities. That’s because the price of peak hour road space (zero) and the price of parking (below cost and often zero) are too low.

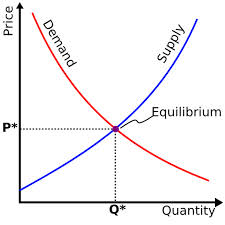

OK, we understand: that undergraduate economics course you took some years back was not your favorite. But if you learned one thing, it was probably this: we can represent the demand for a product (or service) with a “demand curve” that shows the relationship between the amount that consumers will buy and based on the price of the good in question. The quintessential microeconomics chart is one that shows quantity demanded on the horizontal axis and price on the vertical axis. Demand curves slope down and to the right, meaning that at high prices consumers buy very small amounts of a given commodity, and at lower prices they buy more. (See the red line on this chart).

The most basic concept in economics is the idea that when the price of something goes up, people buy less of it. This relationship turns out to be critically important to understanding things like transportation, energy consumption, and climate change. For example, when the price of gasoline goes up, people adjust their behavior so that they buy less. In the short term they may cancel or combine some trips, in the longer term they might buy a more fuel efficient car, or move to a location where its easier to bike, walk, take transit, or drive fewer miles for daily errands. This basic fact is the intuition behind the carbon tax, as explained by Bill Nye (who for your benefit, doesn’t invoke the demand curve to make this point).

And the reason we’re in such a mess in the US when it comes to sprawl, car dependence and carbon emissions, is that driving is so cheap that we do way, way to much of it. The total social, health and environmental cost of driving—above and beyond what drivers pay is measured in the billions. Trucking alone has negative social costs of as much as $128 billion per year.

When we get the prices right, or closer to right, people are remarkably capable of adjusting their behavior. We see that in places like Louisville Kentucky, where a $1 a trip toll for using an interstate bridge reduced traffic levels by about 40 percent, and produced nearly empty freeways at rush hour, or more recently in Seattle, where tolling a newly opened downtown tunnel reduced traffic by a third, and also reduced traffic on nearby city streets.

Higher fuel prices = less driving

The clearest example of the price elasticity of demand in transportation is for gasoline prices. When gas prices go up (in a significant and sustained way) people adjust their behavior, by driving less, riding transit more, buying more fuel efficient vehicles, and moving to more central locations. The simplest way to show this relationship is to look at the average price of gasoline in the US, and compare it to the average number of miles people drive each year. Here are the data from the US DOT (miles traveled, per person per day) and average gas prices (from the US Department of Energy).

Around the turn of the millennium, gasoline was cheap, and had been so for a long time, and Americans reacted predictably, driving more and more each year. But starting in the early 2000’s gas prices started rising, and particularly after 2004, gasoline was noticeably more expensive than it had been in the prior decade. At exactly the same time, the number of miles driven by Americans peaked, and then started declining. As the nation experienced $4 a gallon gas for the first time in 2007, driving dropped precipitously. The drop continued through the Great Recession (more about that in a minute) and the decline in driving continued right on through 2014.

In 2014, the global price of oil collapsed, and almost overnight, retail gasoline prices fell by about 40 percent. In June 2014, the average price of gas was $3.69, just seven months later, the price was $2.04, a decline of 44 percent.

Very quickly, consumers reacted to the new lower price of gasoline. Vehicle miles traveled per person shot up, from 25.7 vehicle miles traveled per person in 2014 to 26.9 vehicle miles traveled per person in 2017. And the increase in driving, predictably, led to an increase in traffic deaths.

But the decline in gas prices was more or less a one-off stimulus to increased driving. Gas prices stopped going down, and trended mostly sideways after early 2017. And not surprisingly (to an economist at least), the rebound in per person driving flattened out. In short, the dollar or so a gallon reduction in gas prices that persisted after 2014 added about a mile a day to the average distance traveled by Americans, but didn’t put us back on the growth path of the late 1990s.

It’s hard to find a clearer and more easily understandable example of how price elasticity of demand works. If you want people to drive less, raise the price of driving. (Gasoline is the most visible variable price associated with car use; too most drivers, their car payments, maintenance and insurance are relatively fixed costs). Gasoline (and parking) are just about the only things that fluctuate with the number and distance of trips taken.

What the studies say

Economists routinely study the price elasticity of demand using gasoline as a classic example. Studying gasoline markets is a tempting target because its a relatively fungible commodity (a gallon of 87 Octane unleaded gasoline is the same in one city or state as another, and remains comparable over time), there’s a treasure trove of data on prices (the federal government publishes weekly average price data), and it’s a purchase that consumers make often.

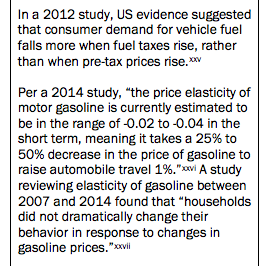

The indispensable Todd Litman has published a summary of the literature on the price elasticity of demand for gasoline. In general the estimates are that the price elasticity is 0.1 in the short run and 0.3 in the long run. And elasticity of 0.3 means that a 10 percent increase in gas prices is associated with a 3 percent decrease in consumption. Elasticities are almost greater in the long run because over time, consumers have more different possible ways of responding to a change in prices. If the price of gas goes up a $1 a gallon tomorrow, you cannot instantaneously change your job and commute, your vehicle, your place of residence etc). But over time, faced with higher prices, consumers do all these things, and others, and can reduce how many gallons they buy and how many miles they drive.

There are good reasons to believe that many of the economic subsidies under-estimate the elasticity of demand, especially in the long run. Most studies look at relatively short term responses to price changes, and measure changes in prices that themselves are both small, and frequently varying. There’s a lot of “noise” in gasoline prices, with prices fluctuating by 5 or 10 cents a gallon month to month or seasonally. It’s unlikely that consumers react to these small of temporary fluctuations in price in the same way that they react to a large and permanent change in prices. As Litman notes, people appear to have a stronger reaction to changes in fuel taxes (which are more nearly permanent) than they do to fluctuations in market prices. In addition, most elasticity estimates are based on time-series data for US markets. The cross-sectional international data on fuel prices and driving shows that in countries where gasoline is more expensive, people drive many fewer miles. The strength of this relationship underscores how, in the long run, permanently higher prices for fuel are reflected in changes in the built environment, household location, transit use, and other factors, that aren’t captured by estimates of short term changes.

We can also see the same pattern within and across US cities. Where driving trips are more expensive, chiefly because of the cost of parking, people avoid driving their cars. Transit trips are disproportionately taken to destinations where parking is limited and expensive; conversely, few people take transit to places where parking is abundant and free. Charging for parking is a kind of surrogate road pricing that produces discernible changes in behavior.

Transportation planners don’t believe in price elasticity or prices as policy

As we’ve pointed out at City Observatory, the higher price of fuel has an important side benefit. By reducing the total amount of travel, higher gas prices turn out to be an extraordinarily effective means of reducing traffic congestion. Between 2010 and 2012, when fuel prices were high, traffic monitoring firm Inrix reported that traffic congestion went down in every US metropolitan areas but one. One of the key factors at work here is the non-linear relationship between traffic volumes and traffic congestion. Traffic congestion is a “tipping point” phenomenon—roads function at high capacity right up to the point where they become congested, and after that point is reached, an additional car (or ten) causes the road to slow down and lose capacity. As long as you can keep traffic below the tipping point, roads work well. And, as it turns out, that’s just what high fuel prices do, and the small reduction in traffic volume produces a big decrease in traffic congestion; Inrix data show that a 2-3 percent decrease in traffic volumes between 2010 and 2012 was associated with a 30 percent decline in traffic congestion.

Given the abundant practical and scientific evidence of the price elasticity of demand, and the dramatic congestion-busting benefits of small reductions in traffic, you’d think that transportation planners would be keen to understand and use prices, especially fuel prices, as a key component of the transportation policies and plans.

But in fact, when it comes to price elasticity, many transportation planners are flat-earthers. They either ignore or deny the existence of any price elasticity of demand. Take the transportation modelers working for Portland’s regional government, Metro. When pressed about how their modeling of future transportation demand accounts for possible changes in fuel prices, they essentially argue that fuel prices have no effect whatsoever.

Fuel costs within the Metro travel demand model are considered as part of the auto operating cost, which consists of gasoline and oil, tires, and general vehicle maintenance costs on a per mile basis. This cost is $0.21 per mile (in 2010$ — $0.25 per mile in 2019$), and is derived from Bureau of Transportation Statistics (BTS), Energy Information Administration (EIA) and AAA data. Empirical evidence has shown that auto operating costs tend to remain stable or decrease over time, regardless of short term fuel cost fluctuations. VMT per capita has not been shown to be highly correlated to fuel price fluctuations over the medium and long-term which is the scale of time used in our planning analysis. Long-term increases in fuel cost will result in wider adoption of fuel-saving technologies, which offset the increases in cost. Instead fluctuation in VMT per capita tend to be most correlated with economic health (employment) and this accounts for the changes between 2005 and 2015, with the 2008-2012 slump in VMT occurring with the decreased regional employment in our region associated with the Great Recession.

(Source: Email from Metro Staff, dated October 23, 2019).

It’s possible, of course, to have a debate about what the appropriate value is for the price elasticity of demand. We think, especially from a look at the international cross-sectional evidence that it’s probably higher than the 0.1 short term/ 0.3 long term estimates presented by Litman. It might be lower. But there’s no study, anywhere, that supports an estimate of 0.0, which is exactly the figure that the Metro modelers are using. In their view, it doesn’t matter whether gas is 10 cents a gallon or 10 dollars a gallon, they’re predicting exactly the same amount of travel.

When pressed to reconcile their position with the historical data showing the reversal and then decline in driving per capita when gas prices accelerated in the middle of the last decade, transportation planners (like a CEO on a bad-news earnings call) jump to blame the economy: It was the Great Recession that causes the decline in driving, they argue.

There are at least three huge problems with that blame-game. The first is that vehicle miles traveled per person flattened out and started declining well before the Great Recession occurred, so unless you’re arguing consumers were somehow clairvoyant, that’s not an explanation. The second is that vehicle miles traveled per person continued to decline even after the Great Recession ended and the US was growing robustly again. According to the National Bureau of Economic Research, the Great Recession ended in May 2009—the shaded gray bars on the chart above. In fact, US employment grew for five full years through 2014, with continuing declines in VMT/person. Third, as we’ve noted before, the rebound in VMT per capita was tied directly to the decline in fuel prices, and petered out almost completely when gas prices stopped declining. If VMT were driven just by job growth as these planners assert, it would still be growing; it isn’t.

Why this matters: Getting the prices right helps achieve all of our goals

Because of well-demonstrated responsiveness of consumers to higher prices, pricing can be our most effective strategy for reducing road congestion and decreasing energy consumption and greenhouse gas emissions. Yet tragically, those who are preparing the technical basis for future transportation plans are in complete denial that price elasticity of demand exists. In fact, they implicitly argue that the demand for driving is perfectly inelastic—that no matter what price we charge for fuel, drivers will drive exactly the same number of miles, by the same modes, to the same destinations. That is certainly a simplifying assumption—it’s harder to model a world with different prices and demand for travel than to build a model where behavior isn’t affected by price changes. But what that means is that the model is unrealistic: it’s a simplification that does violence to the utility of the model and importantly, uses a deeply buried technical process to preclude any discussion of one of the most powerful and effective tools available for achieving our stated policy objectives.

What this means is that our plans for the future are systematically ignoring one of the most powerful forces that we can use to reduce traffic congestion (and not incidentally, greenhouse gas emissions). If we have higher prices for gasoline, people will drive less, we’ll have less traffic congestion, we won’t need to build as many roads, and our transit system will work better. In addition, there’s powerful evidence that cheap gasoline has stimulated more driving, which has led to proportionately greater numbers of crashes, injuries and deaths on the nation’s roadways. By denying that prices matter, transportation planners are missing a huge opportunity to harness market forces to achieve all of the policy objectives we’re hoping to further.

Addendum: More understatement of Price Elasticity of Demand

A newly released Metro report on possible options for financing a regional transportation measure also significantly understate the price elasticity of demand for travel. The report, prepared by ECONW, contains references to two articles, which it refers to as “studies.” In fact, neither is a study, and in both cases the data presented don’t support the claims made.

The first is from a 2014 US Energy Department website. It’s worth noting that this is a web news article (“Today in Energy”) rather than an actual study. The author speculates on the effects of the 2014 decline in retail gasoline prices. The article doesn’t actually look at data in comparing VMT and gasoline prices from the period after the decline in gas prices; in fact, it only shows data through 2012 (see the chart below). As shown above, the decline in gas prices was followed by a reversal in the decline in VMT–exactly opposite of what this article predicted.

The second item is from a similar US Department of Labor website. This website article’s lead author is described as a “former summer intern.” Just like the Energy Department web article, this report isn’t a formal economic study, doesn’t cite any literature, and reports no data post-2014. Also, it focuses only on gasoline consumption, not VMT. The report says that there wasn’t a “dramatic” decrease in gasoline consumption. But the data in the DoL report show that per household gasoline consumption declined by 16 percent between 2005 and 2014 (from 844 to 707 gallons per household), during a period of high and rising gas prices, fully consistent with the idea higher gas prices dampen fuel consumption and driving. Finally, it’s worth noting that the term “inelastic” means an elasticity of less than one, i.e. that a 1% increase in the price of good produces less than a 1% decline in its consumption. “Inelastic” doesn’t mean zero elasticity, i.e. that the price has no effect on the quantity demanded.

Even the Oregon Department of Transportation concedes that gas prices play a key role in shaping vehicle miles traveled. Their 2018 report on the non-attainment of state climate goals says, ” . . . lower gas prices coupled with higher incomes and post-recession increases in driving means that vehicle miles traveled (VMT) have increased in Oregon.”