Timing is everything in real estate, and mortgage availability cycles mean that people of color buy high and sell low.

The Urban Institute has an informative new report charting the swings of home prices across the nation since 2000. It shows a familiar boom-bust-recovery pattern. Home prices surged through about 2006, and collapsed in the next few years, and since 2009, have been increasing–although as we’ve noted at City Observatory, real home prices (adjusted for inflation) have still failed to recover to their peak levels in most markets).

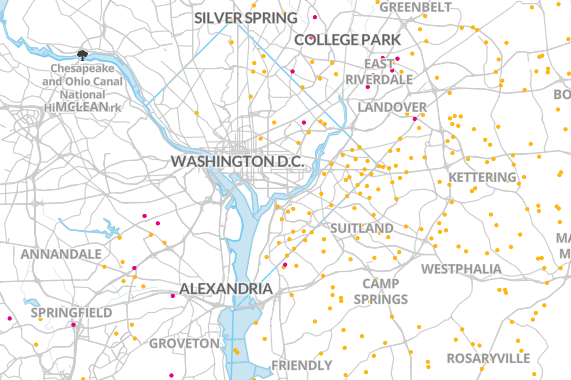

The Urban Institute’s map of changing home prices illustrates in detail how this has played out in different communities, and its a great resource. You can see, by metro area, and by year, where homebuyers of different racial and ethnic groups are concentrated, and how patterns change over time. Here, for example, is a map showing the concentration of mortgage originations to African-American homeowners in the Washington DC area. The largest concentration of mortgages is in Prince Georges County, Maryland:

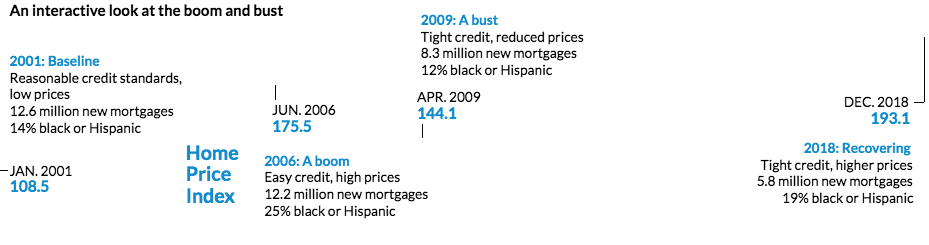

But it’s useful to step back and reflect on the big trends at work here, which Urban Institute neatly summarizes in this graphic:

Credit availability and home prices tend to move in sync; when credit availability is low, price growth tends to be subdued; when credit is easily available, prices

As the old investing adage goes “Buy low, sell high.” To buy a home you need access to mortgage credit. But when its the best time to buy, credit is usually hard to get, and especially so for people of modest means, and disproportionately so for black and Hispanic households. And that’s exactly what Urban Institute’s data shows. Black and Hispanic borrowers accounted for about 13 percent of home mortgages in 2000 (when prices were relatively low). The black/Hispanic share of mortgages surged to 25 percent when the market was at its frenzied peak in 2006. And the black/Hispanic share of mortgages fell back to 12 percent in 2009, when the market hit bottom (arguably the best time to buy).

What this means is that Black and Hispanic homebuyers disproportionately tended to buy homes at the very worst time–when home prices were at their peak, and were effectively shut out of the market when it was a good time to buy.

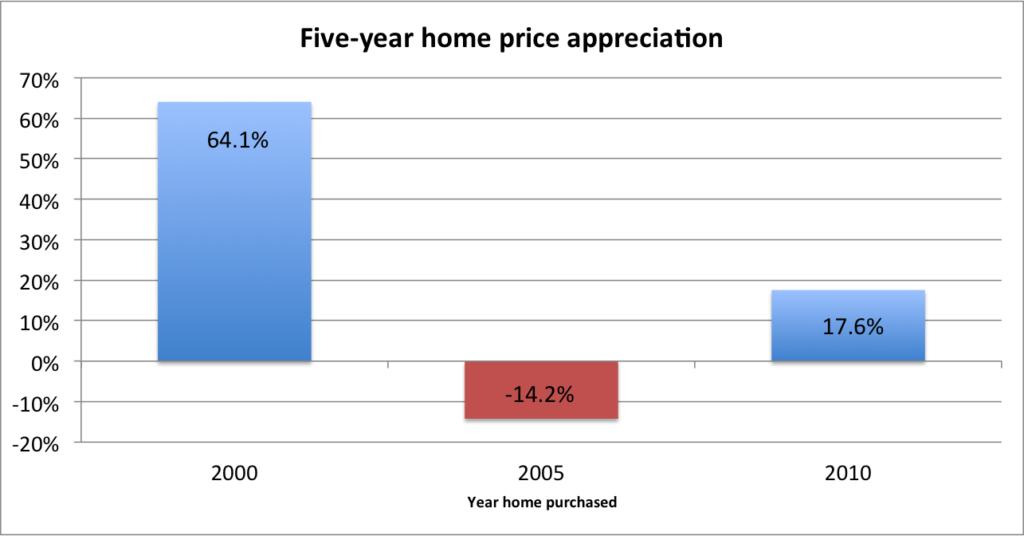

To get an idea of how big a deal this makes, let’s compare what happened to the typical home buyer who purchased a home and held it for 5 years. We use data from the national Case-Shiller home price index to compute the price level and appreciation of the average home in each year.

Here’s a chart showing the percentage appreciation (or depreciation) that a typical homebuyer would experience based on having bought a home in 2000, 2005 and 2010.

If you’d bought a home in 2000, your five-year gross return would have been about 64 percent, almost ten percent per year. If you bought in 2005, your five-year return would have been negative, and you would have lost 14 percent of your investment. If you bought in 2010, you saw about an 18 percent gross return; a little over 3 percent per year.

So clearly, when you buy makes a big difference. And the fact that lower income buyers, and especially black and Hispanic buyers tend to buy less when prices are low (2000 and 2010), and tend to buy more when prices are high (2005), means that housing turns out to be systematically a worse investment them. These data show that borrowers of color were twice as likely to take out mortgages when it was a bad time to buy (2006; 25 percent of borrowers), than when it was a good time to buy (12 to 13 percent of borrowers in 2000 and 2010).

What this means is that the “housing as wealth creation” idea is pretty systematically tilted against low income households and people of color. If you can’t buy when it’s a good time to buy, home ownership is likely to be a pretty poor way to accumulate more wealth. And this problem doesn’t seem to be susceptible to an easy fix: expanding mortgage credit to marginally qualified borrowers (something that was the hallmark of the subprime lending that triggered the housing bubble and bust) tends to fuel the home price appreciation that rewards those who were able to buy when credit was tight, and drive up the price of housing for those who are new to the market.

Racial and ethnic gaps in income and wealth are real and persistent problem in the US, and are deeply reflected in patterns of homeownership. But simply expanding access to mortgage credit is unlikely to be a way to make these gaps smaller.