Pricing parking drives demand for ride hailing services

Ride-hailing companies like Uber and Lyft have been highly reluctant to share data about their services with cities. In California, the state Public Utilities Commission has pre-empted municipal access to ride-hail data (and isn’t sharing it with anyone). As Bruce Schaller’s recent study of New York (one place where the city government has compelled access to ride data) shows, the growth of ride-hailing is having a material impact on traffic congestion.

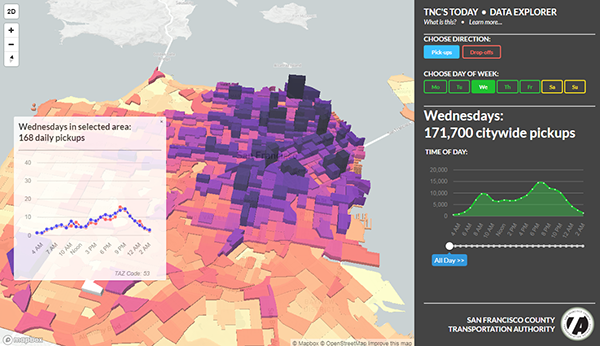

San Francisco’s County Transportation Authority (SFCTA) figured out a clever work-around for accessing ride hailing data. The principal operators like Uber and Lyft rely on a public-facing Application Programming Interface (API) that tracks the location of vehicles and their availability. Researchers for Northeastern University scraped this data in real time for six weeks for trips beginning and ending in San Francisco, and used it to create a database of ride-hailed trips in the city.

Aggregating it with other city data on traffic volumes, SFCTA was able to use this data to compute what share of all trips in various parts of the city were taken using hailed rides at various times of day. Overall, the study showed that there were nearly 170,000 ride hailed trips with both ends in the city on a typical weekday last fall. (Ride hailing varies by weekday and peaks on Friday and Saturday evenings.)

While ride hailing services covered the entire city of San Francisco–and, its fair to say, provided more rides in outlying parts of the city that did conventional taxis–ride hailing trips were highly concentrated in the city’s densest urban neighborhoods. In the downtown area, ride hailed trips accounted for as much as 20 percent of all traffic.

In past months, we’ve looked at the penetration of ride hailing services in different markets (using data developed by the Brookings Institution) and we’ve correlated that with a rough proxy of metro area parking prices. We found that ride hailing had the highest market penetration in those metro areas with the highest parking prices. We think that makes a lot of sense: hailing a Lyft or an Uber can save you time and money if parking near your origin or destination is hard to find or expensive. But if parking is free or abundant, it may be cheaper, easier and faster to drive your own vehicle.

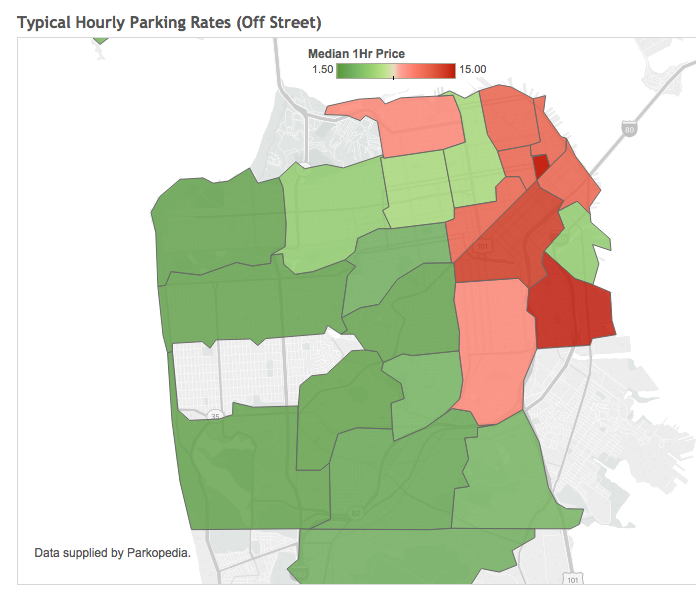

The new San Francisco ride-hailing data give us a more refined way of looking at the parking price-ride hailing connection. Instead of looking at aggregate metropolitan data, we can now look at neighborhood level data and see how variations in parking prices among neighborhoods correlate with ride-hailing use.

Our data on parking rates come from the web-site Parkopedia, which tracks the location, number of parking spaces, and advertised hourly and daily parking rates for off-street parking across the nation. We aggregated Parkopedia’s data on San Francisco parking lots and garages by zip code, and computed the median price of an hour of parking. Parking ranges from around $15 per hour in the densest zip codes down town, to $2 or less per hour in the cities least dense residential neighborhoods. Several zip codes had no data entries in the Parkopedia database, suggesting that there are few, if any, paid, off-street parking lots in these neighborhoods.

While we haven’t done a statistical correlation (the SFCTA data is aggregated by traffic analysis zones and the parking data is by zip code) a quick visual comparison shows that the highest levels of ride-hailing activity are in the same parts of the city that have the highest parking prices.

This is more evidence suggesting that pricing plays an important role in shaping transportation behavior. The biggest market potential for ride-hailing services is where there’s a density of prospective customers who face relatively high prices for storing their vehicles. While that (coupled with surge pricing) makes downtown streets at peak hours a lucrative place for ride-hailing vehicles to ply their trade, it also means that they are contributing to traffic congestion. And unless cities take the step of pricing the use of their limited peak hour street capacity, they’re likely to be overwhelmed by this demand (and see the ride hailing business capture the economic rents associated with the use of the public right of way). Cities everywhere should be closely following the work being done in New York and San Francisco; as ride-hailing grows, and with the likely advent of fleets of autonomous hailed vehicles, these same issues will appear elsewhere.