What City Observatory this week

1. It’s not a bridge replacement, it’s a 5 mile long, 12 lane wide freeway that just happens to cross a river. The Oregon and Washington highway departments are trying to revive the failed Columbia River Crossing project, peddling it as the “I-5 bridge replacement” project. That’s incredibly misleading moniker. While it sounds modest an innocuous, its anything but: It’s really a 5-5-5 plan: Spend upwards of $5 billion widening five miles of the I-5 freeway, and pay for (a fraction of the total costs) by charging each vehicle round trip $5. The images of the project—which the two DOTs have carefully excised from their public presentations—show a monster freeway that Representative Peter DeFazio called “gold-plated.”

It’s a sly and deceptive bit of marketing to dub this giant freeway widening plan a “replacement,” but creating the illusion that this is just fixing a dilapidated and outdated structure is exactly the way state highway departments divert money that could be used for repairs to underwrite oversized boondoggles.

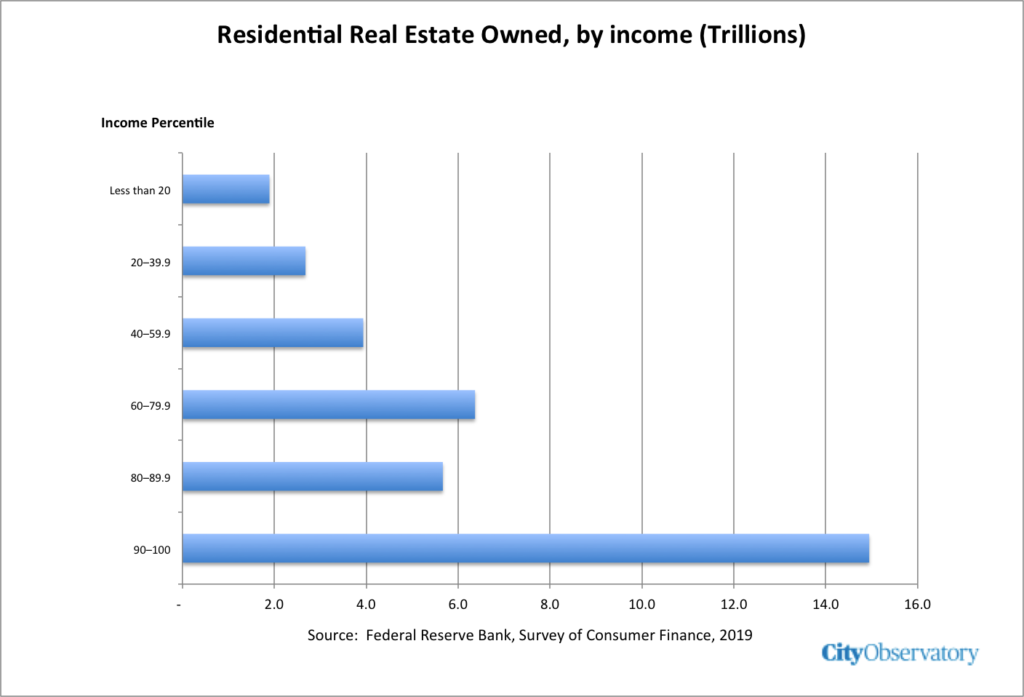

2. We found the speculators who reaped $2 trillion in profits from the housing market last year. The public discussion about housing affordability often devolves into a search for villains: greedy developers, foreign investors, Wall Street banks buying up single family homes. But new data from the Federal Reserve shows who pulled in $2 trillion in capital gains from housing in 2020: older, whiter, richer homeowners. Last year’s gains from housing appreciation were three times greater than the total pre-tax household income of the bottom twenty percent of the population. And under the federal tax code—which generally exempts $500,000 in housing capital gains from taxation—most of that income is tax-free.

As this chart shows, more than half of all the nation’s residential real estate, about $20 trillion worth, is in the hands of the wealthiest one-fifth of all households. They are the ones who are the big winners from the increases in home values attributable, in significant part, to the policies designed to encourage home ownership. And while these policies build wealth for mostly older, whiter homeowners, there’s no comparable wealth-building program for the one-third of the nation’s households who rent and who are disproportionately younger, lower income people of color.

Must read

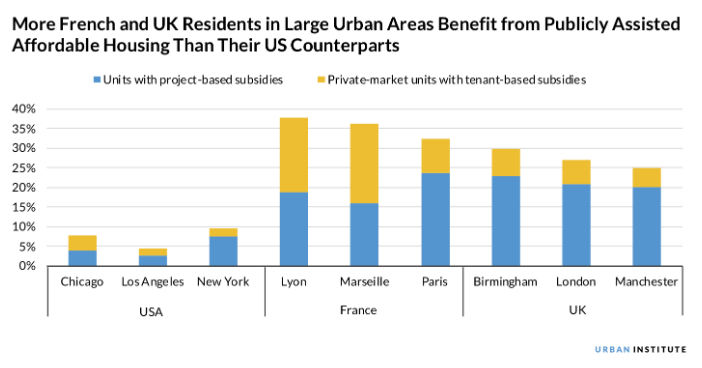

1. Housing lessons from the old school masters. The Urban Institute’s Yonah Freemark contrasts the generous and geographically well-distributed pattern of social housing in European cities with the much smaller and segregated public housing in the US. As much as one third of housing in large metro areas in the United Kingdom and France are publicly owned or subsidized, compared with less than 10 percent in comparable US cities. Here Freemark compares the shares of housing in each of the nation’s three most populous cities that are either social or subsidized housing:

In the US, housing subsidies reach perhaps of fifth of those who are technically eligible; in Europe, housing benefits are much closer to universally available to those who qualify. And Freemark points out there’s an important spatial difference in social housing on the two sides of the Atlantic. In the US, most public or subsidized housing is concentrated in city centers, and usually in low income neighborhoods or a dis-favored urban quarter. In Europe, its far more common to have social housing spread throughout a metro area, including both cities and suburbs.

2. Why artificially cheap gasoline is the opposite of just. The reason we drive—and pollute—so much in the US is that car ownership and use is heavily subsidized. One of the deepest subsidies in the US is the very low price of fuel. Road taxes don’t even cover the cost of building and operating roads, much less the social and environmental damage of driving. US fuel taxes are roughly one-fifth the average of other industrialized countries. Charging a price that reflected these costs would lead people to drive less, buy more efficient cars, and choose safer and more environmentally sustainable modes of transport. But we’re told that any increase in fuel prices would be somehow unfair to low income households. The Frontier Group’s Tony Dutzik challenges that thinking, pointing out that low income families bear the brunt of climate change, and are disproportionately carless, meaning they also suffer from being second class citizens in a car-dependent world. Most of the economic benefit of artificially low fuel and road prices flows to higher income households, which is inequitable. And in a global context, delaying effective action to reduce US greenhouse gas emissions actually does more to hurt the poor around the world, who are much more vulnerable than even low income Americans.

3. The great ICE hangover. It’s easy to get enthralled with the idea that electrifying the vehicle fleet will be a simple means to reducing greenhouse gas emissions. But the Transportist’s David Levinson has some sobering thoughts about the fossil fuel hangover implied by the huge existing inventory of internal combustion engine vehicles. It’s still the case that more than 95 percent of new vehicles have ICE motors, and electric car productions is ramping up only slowly. In 2030, the vast majority of the nearly 300 million cars on US roads will still be ICE vehicles. Given the huge sunk costs in both the vehicles, and the fossil fuel industry (from wells to filling stations), there will be strong incentives for both producers and consumers to keep using ICE engines. As Levinson explains:

One of the undiscussed features of transport electrification is the large number of internal combustion engine (ICE) vehicles that will remain on the road in the absence of prohibition. There are many stranded incumbents like service stations and their upstream suppliers who will continue to provide fuel for the remaining vehicles, and that fuel will have a lower and lower market price (sans taxes), as demand will have dropped and the supply will not, and existing producers will have huge incentives to pump fuel while it still has some market value. Consumers with older cars will be reluctant to replace their working vehicle when low fuel prices abound. Many just like their cars, and the smell of gasoline is an attractant for some.

It’s a problem that could be solved, Levinson argues, by throwing money at it—about $750 billion by his calculations, to buy-back the existing ICE-engine cars. There’s a certain internal logic to the idea, but if we’re serious about dealing with climate change, should we be spending three-quarters of trillion dollars here, rather than on more compact urban development, or solar panels? And why financially compensate those who (a decade or more from now) have decided to buy vehicles we know are contributing to the destruction of the planet.

New Knowledge

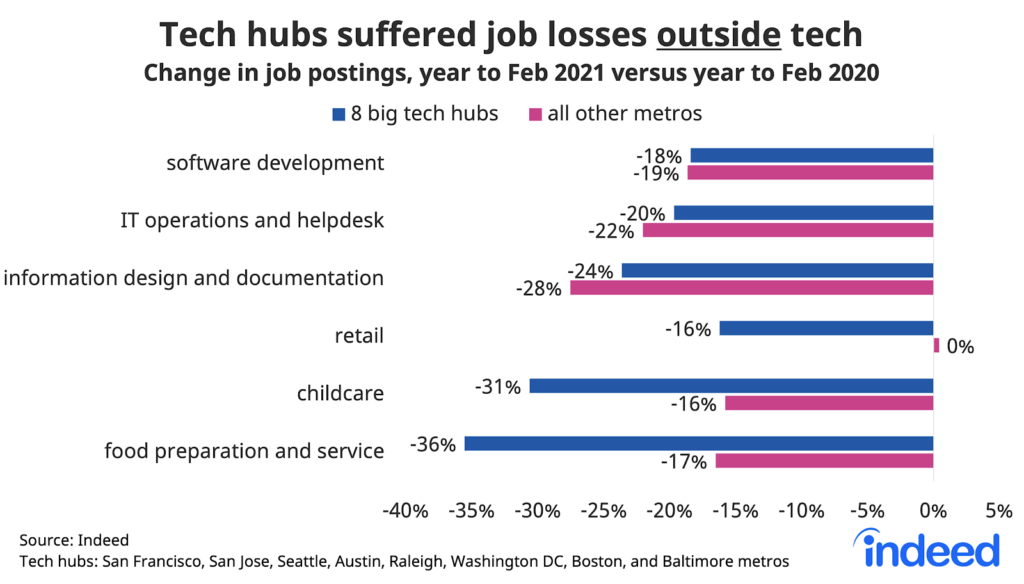

The pandemic hasn’t dethroned tech centers. The surge of “work at home” activity during the Covid-19 pandemic has given rise to the idea that tech centers, like Silicon Valley, will lose their edge. If workers can work remotely, from anywhere, why would they pay the high costs of living in generally more expensive superstar cities. This is especially true for tech workers, who spend much of their time glued to their computers in any case.

New data from economist Jed Kolko of Indeed.com shows that the geographic concentration of hiring activity by major tech companies hasn’t waned at all during the pandemic. If anything, the eight leading tech centers have cemented their dominance of tech-related hiring. While overall hiring growth has been somewhat slower in tech hubs than elsewhere, it’s entirely due to a much weaker performance in non-tech industries in those hubs. The decline in consumer spending by tech workers working remotely has apparently had a vastly larger impact on these tech hub economies than any relocation of tech workers to other metropolitan areas.

Indeed tracks data on hiring announcements by firms in a wide range of industries. Their data compare the change in job postings in 8 major tech hubs with other large US metros between February 2020 (just prior to the pandemic) and one year later. Job postings in tech sectors, like IT and software, declined by just about the same amount in tech hubs as other metros. The big difference in hiring patterns is in other, local-serving industries, like retail, child care and restaurants, where tech hubs had notably larger declines in job postings that other metros. This suggests that the big impact of work-at-home on local economies has not been to shift the location of tech employment, but rather to reduce local spending in places that have lots of tech workers (who can work remotely, and who have reduced their out-of-home spending as a result). If or when these tech hub workers return to the office in a post-Covid world, we might reasonably expect those local-serving jobs to rebound as well.

Jed Kolko, “Tech hubs held on to technology jobs during the pandemic,” Indeed Hiring Lab, May 6, 2021. https://www.hiringlab.org/2021/05/06/tech-hubs-held-on-during-pandemic/

In the News

Oregon Public Broadcasting cited City Observatory’s analysis of the destructive effects of freeway building on Portland’s Albina neighborhood in it’s story “A freeway once tore a Black Portland neighborhood apart. Can new infrastructure spending begin to repair the damage?”

Sightline Institute pointed its readers to our story on the true dimensions of the so-called “I-5 Bridge Replacement Project.”

Correction

The originally published version of our commentary, “How ODOT destroyed Albina: The Untold Story,” incorrectly claimed that ODOT’s Rose Quarter analysis had not acknowledged the destruction of housing by the construction of Interstate Avenue in the early 1950s. In fact, one table contained in the project’s environmental justice section concedes that this project demolished at least 80 homes. We have corrected this story to incorporate this information. Thanks to a regular reader who pointed this out. City Observatory regrets this error.