What City Observatory did this week

An open letter to Secretary Pete Buttigieg on his visit to Oregon. Transportation Secretary Pete Buttigieg came to Oregon this week to look at some local transportation innovations. The group No More Freeways, which opposes an Oregon Department of Transportation plan to widen I-5 through Portland’s Rose Quarter wanted to enrich his travelogue with some additional information.

In light of the Biden Administration’s commitment to promoting equity, restoring the damage done by the construction of freeways through urban neighborhoods and fighting climate change, the letter suggests that Buttigieg might want to direct the Federal Highway Administration to do a full Environmental Impact Statement on the ten-lane $800 million freeway-widening project, rather than claiming it has “no significant environmental impact.”

Must read

1. Covid didn’t kill cities. When the coronavirus shut down New York City in the spring of 2020, fears about the future of urban life ran wild. Were we ever going to see cities thrive again? Was it unsafe to live in highly dense areas? People prophesied that the pandemic would bring the End of Cities. This doomsday never arrived though. Cities survived the catastrophic event, as they always do. In this New York Times article, Emily Badger ponders the question, “What is so alluring about the perpetually imminent End of Cities?” The author explores the roots of this narrative and its connection to personal experience as well as aspirations. Anti-urban sentiment has been present since early America as cities have been intrinsically tied to corruption and the stereotypes surrounding people of color and immigrants. Badger speculates that there is an anti-urban element within all of us, which can be triggered by uncomfortable moments. It makes us feel as though a city can be punished for its adverse qualities. The pandemic provided a reason to be alarmed by the nature of city life and provided a form of “retribution,” making this doomsday narrative attractive. However, this sentiment is predominantly one of White professionals and fails to capture the reality of most residents. At the end of the day, the catastrophic end of cities has not arrived. Cities will persevere through this pandemic and the next.

2. How bad is rent inflation? Alarming says the WaPo. Not so fast says Kevin Drum.

“Rent prices are up 7.5 percent so far this year,” cried The Washington Post this week. Using Apartments.com and Zillow data, Heather Long makes their case for this alarming spike in rental prices across the country. The article highlights the increases in rent prices of cities like Phoenix, Boise, and Stockton (deemed the “Inland West”). Long calls on prospering landlords and struggling residents to further her argument. The article concludes with an ominous warning for inflation: if rent prices continue to increase at these exorbitant rates, we should be prepared for other prices to increase as well.

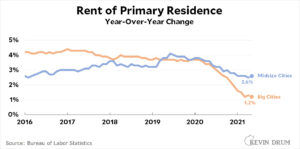

Kevin Drum disagrees. In his blog post, Drum refutes Long’s claims of stark rises in rental prices using data from the Bureau of Labor Statistics. He argues:

“Not only have rents not risen 7.5% so far this year, BLS says they’ve risen a paltry 0.5% in big cities and less than 1% in midsize cities since January. And rent growth has been falling steadily for over a year. Compared to 12 months ago, rent is up a very modest 1.2% in big cities and 2.6% in midsize cities.”

As it turns out, roverall ents are not increasing by the alarming 7.5 percent. The Washington Post article essentially cherry-picks booming rents in selected cities. It ignores the declining rental prices in bigger metropolitan areas like Seattle and New York. Rents will always be surging in some cities and lagging in others, but that does not justify causing alarm across the entire nation. Don’t fret, today’s boom in Phoenix’s rental prices unlikely to trigger national inflation.

3. Single-family zoning and the right: False populism of the NIMBYs. Writing at New York Magazine, Eric Levitz underscores the contradictions and faux-populism of right-wing commentators like Tucker Carlson, who fail to acknowledge the critical role that single family zoning has in worsening housing affordability for low and middle income households, while simultaneously decrying policies that would make housing more affordable. Levitz writes:

‘What makes his [Tucker Carlson’s] defense of single-family zoning so instructive is that it’s both anti-free-market and anti-working-class…. For the downtrodden “forgotten men and women” whom right-wing populists claim to champion, single-family zoning is actually a scourge. It prevents homeowners in economically depressed regions from affordably relocating to thriving metros. And it forces renters to forfeit an ever-higher share of their income to landlords…. Viewed from the perspective of society as a whole, single-family zoning is ruinous….

Carlson and others may be addressing economic anxieties, but they are those of homeowners looking to guard their wealth, and to maintain financial, geographic and social distance from the lower class.

Carlsonism is a politics of downward-looking class resentment disguised as its opposite…. This era’s self-styled populist conservatives have consistently demonstrated their fealty to small-time capitalists—and contempt for the median laborer—in just about every major policy fight of Biden’s tenure.

As we’ve shown at City Observatory, housing wealth (and appreciation) accrues largely to wealthier, whiter, older households. If we’re talking about working class Americans, especially younger generations and people of color, single family zoning isn’t helping them prosper.

New Knowledge

Black Entrepreneurs, Job Creation, and Financial Constraints. According to the Federal Reserve’s Survey of Consumer Finance, the current racial wealth gap remains awfully similar to the 1960s. The median and mean wealth of Black families is less than 15 percent of white families. What impact does this disparity have on Black entrepreneurs and their business?

Research by Mee Jung Kim, Kyung Min Lee, J. David Brown, and John S. Earle analyzes these Black-White differentials in wealth, financial constraint, and employment. Black-owned businesses tend to have fewer resources, creating a greater dependence on outside funding. At the same time, they are less likely to receive a bank loan. Overall, Black owners face greater financial constraints compared to white owners, a phenomenon likely inflated by information asymmetries and racial discrimination. The research provides an in-depth look at the differences in characteristics among Black and white businesses. The authors find that Black owners, on average, are more likely to be younger, have higher education, greater motivations for entrepreneurship, and manage younger, smaller firms compared to white owners. Black-owned businesses have about 12 percent fewer employees that white-owned businesses. However, the researchers’ empirical analysis implies that with the same financial access, Black-owned firms would actually be significantly larger than white-owned firms.

The research also explores the impact of an intervention, the Community Reinvestment Act. They find that increased access to credit enables Black-owned firms to grow faster. Expanded credit access enabled by the CRA raises employment by 5-7 percent more at Black businesses compared to white firms in the treated neighborhoods. The researchers have a thoughtful discussion on the impact financial constraints have on Black businesses. Their comparison of firm characteristics and employment coupled with an analysis of the CRA underscores a key roadblock Black businesses must overcome. Black entrepreneurs face greater financial constraints, limiting their ability for growth, employment, and success. Looking forward, increasing their financial access through policy like the CRA can help alleviate the disparities we see today.