What City Observatory did this week

1. Renter’s credit scores are rising. What does that mean? New data from RentCafe shows a noticeable increase in the average credit scores of successful applicants for rental housing. In some leading markets like San Francisco, Seattle, and Boston, those who land new apartments have sterling (700+) credit scores. One interpretation is that landlords are getting choosier and more demanding, and that you need a very high score to get an apartment. But its equally likely that rising credit scores for renters signify the strength of the local economy and the steadily improving household prosperity of many urban renters. It’s also the case that many creditworthy households in expensive housing markets can’t afford to buy a home, and by continuing to rent, raise the average credit score of renters.

2. YELP’s new local economic opportunity index. You’re probably most familiar with Yelp’s directory of local businesses and copious consumer reviews. Yelp has taken their massive database and started to use it to generate statistics on the economic outlook in different cities and neighborhoods. Their first product is an opportunity index which looks at the survival probability of different kinds of businesses, and ranks the nation’s metros accordingly. In our view, its a great adjunct to traditional government data, especially because it is more timely. We’re looking forward to seeing this on a regular basis, plus getting additional details on how specific markets are performing.

New knowledge

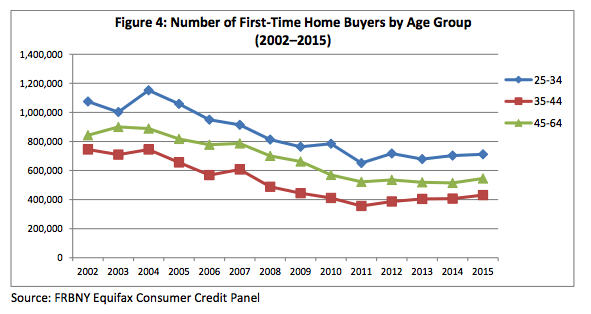

New data trace the decline in first-time home-buyers. The Federal Reserve Bank of Philadelphia has developed new estimates of the homeownership rate in the US, drawing on credit records developed by Equifax. This measure complements existing data which is based in part on either surveys or government-backed mortgage originations. The data broadly confirm the declining trend home purchase by first time buyers, and provide additional detail by age group and other characteristics. Overall, first-time buyers now make up only about 35 percent of home buyers, down from roughly half prior to the housing bubble. The data also show a particularly strong decline in the younger age groups (25-34 and 35-44). Even as the economy has rebounded, there’s been little improvement in the number of first-time buyers in these age groups, perhaps signaling some long run effects of the housing bubble, Great Recession and rising student debt on patterns of homeownership.