What City Observatory did this week

1. Climate change: the two-cent solution. The City of Chicago charges its residents a fee of 7 cents for each disposable grocery bag. The fee provides revenue and more importantly, creates an incentive for consumers to use their own recyclable bags. The small fee is working; plastic bag use is down 42 percent. Why not apply this same concept to carbon pollution? If we charged just 2 cents per pound for every pound of carbon emitted, we’d create strong incentives to use (and to develop) less polluting alternatives. Its remarkable that we readily accept a bag fee that’s about 200 times higher (per unit of weight) than a carbon emissions fee–perhaps its because plastic bags are a visible and local source of waste, whereas carbon dioxide is invisible, and its effects global.

2. What’s the biggest threat facing cities? A recent article at Politco asked more than a dozen urban experts their opinion of the most serious threat to cities in the year’s ahead. The answers ranged from the sensible and obvious (pension crises, major changes in the federal budget) to the obscure and odd (Saskia Sassen frets about the menace of skyscrapers). In our view, Politico left out at least two of the biggest threats to cities: economic segregation and housing affordability. We offer a quick synopsis of the various threats, and invite our readers to ponder this challenge.

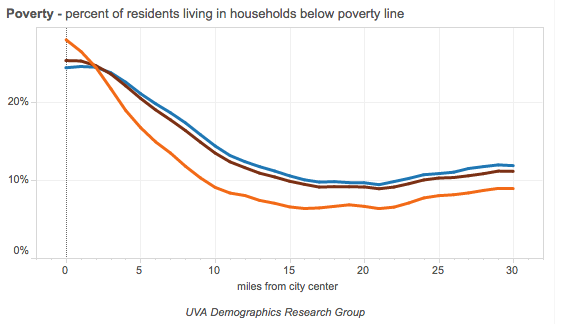

3. Exaggerating the extent of suburban poverty. A popular theme in the past few years has been noting that America’s suburbs aren’t immune from poverty. Poverty rates have increased in suburbs, and in the aggregate more poor people live in suburbs than in the central municipalities of large metro areas. But those statistics miss the key fact that poverty rates, and especially concentrated poverty are far more prevalent in city centers than in suburbs. Moreover, suburbs are not an undifferentiated mass, many effectively exclude nearly all low income households. Poverty rates still decline sharply with distance from the city center. In the 50 largest metro areas poverty rates within 5 miles of the city center are over 20 percent; beyond ten miles they average about 10 percent. And neighborhoods of concentrated poverty are about five times more common in the densest part of metro areas than in the least dense.

Must read

1. Excluding affordable housing from white neighborhoods. The New York Times reports on a proposal to build affordable housing in Houston’s Galleria neighborhood. The proposal’s been strongly opposed by the (mostly white) neighbors, and was rejected by the City Council. Funding for the project comes in part from the federal Low Income Housing Tax Credit (LIHTC), which at least in theory should be governed by the fair housing law, which aims to reduce segregation. But the Times analysis of LIHTC data shows that while only about a third of census tracts in large metro areas are majority-minority, about 54 percent of LIHTC funded projects have been built in such neighobrhoods since 2000, which has effectively reinforced patterns on racial segregation.

2. Are foreign investors driving up housing prices in Seattle and Vancouver? Sightline Institute’s Dan Bertolet takes a close look at the high end housing markets in these two Pacific Northwest cities to tease out the impact of foreign investment on housing prices. It’s widely believe that speculative buyers, especially from China, have pushed housing prices higher in Vancouver, prompting the provincial government to levy a special tax on foreign purchases. Will that cause speculative capital to shift to Seattle? Bertolet finds that the impacts even in Vancouver appear to be small, and that it’s most likely that its the growing local demand for housing, coupled with legal and practical limits on the rate at which housing supply can increase that’s chiefly fueling high prices and rents in these two markets.

3. A record number of apartments are likely to be delivered this year. Using data from Yardi Matrix, RentCafe.com reports than nearly 350,000 apartments are likely to be added to the nation’s housing stock in 2017, the largest number in two decades. As a result of the surge in completions, rents are softening, and in some markets, even declining: “From an affordability standpoint, things are starting to look better for renters,” according to Doug Ressler, Yardi Matrix senior analyst. “Rent growth is slowing down, even in the country’s most expensive markets and it doesn’t stop at that. ” The RentCafe story has market by market estimates of the number of apartments expected to come on line in 2017.

New ideas

New ideas will return next week.