The amount of office space allotted to each worker is shrinking. What does that mean for cities?

Last week a new report from real estate analytics firm REIS caught our eye. Called “The Shrinking Office Footprint” this white paper looks at changes in the demand for office space over the last couple of business cycles. The full report is available free (with registration) from REIS.

An increasing share of jobs in the US economy are in the kinds of industries and occupations that are housed in leased office buildings. Knowledge-based industries like finance, software, business and management consulting services, market and communications and a range of similar businesses house most of their employees in commercial offices. Of course, investors in the real estate business keenly follow data on office lease rates and vacancy trends to look to see where it is most profitable to buy or build new office buildings. And the leasing of commercial offices is a useful indicator of changes in economic activity.

The REIS report offers up a number of interesting findings. Overall, their data (which stretch back to 1999) illustrate the depth and severity of the great recession. When the economy nose-dived in 2008, businesses laid off employees, and lots of office space went begging. And while vacancy rates shot up, they actually understated the extent of the impact on real estate. Many firms had five-, ten- or even fifteen-year leases on their office space, and we’re stuck with “shadow” space.

As a result, as the economy began to recover, there was lots of room (literally) for companies to expand their payrolls without expanding their real estate footprint. As a result there’s a clearly cyclical pattern to the relationship between hiring and new office space leasing. Early on in a recovery, when firms are filling up un-used or under-used shadow space, they consume relatively small amounts of additional office space per new employee. As the recovery grows, more firms reach or outgrow their capacity, and then lease additional space. (You see this pattern clearly in the REIS data: square feet absorbed per new employee rises through the business cycle.

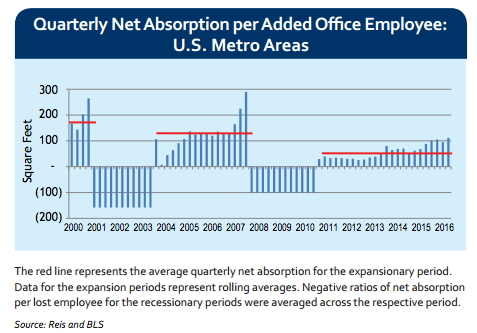

What’s more interesting though, is how the amount of office space per employee has been steadily declining in each successive business cycle. The metric to pay attention to here is “net absorption” per added office employee. Net absorption is the different in the number of square feet office space that is leased compared that which becomes vacant. In the expansion of the late 1990s, REIS reports that the average additional employee was associated with about 175 additional square feet of office space. In the late 2000s, up until the Great recession, the typical employee was associated with about 125 square feet of additional space. During this decade, each added employee has been associated with only about 50 square feet of additional office space. Nationally, we’ve added about 3.5 million office workers, and leased about 180 million additional net square feet of office space. (See the red lines on the following chart).

What this reflects is a number of things: the companies that are growing may be those that make the most efficient use of space. While space intensive industries like manufacturing have been growing slowly or declining, space efficient industries like software have been growing. We also know that hotelling and remote work–arrangements where employees share space, rather than having dedicated offices or cubicles–enables firms to accommodate more workers in any given amount of space. While some of the relatively low rate of absorption per worker represents a hangover from the recession’s “shadow space,” Reis believes that much of the decline in space per worker is permanent: they conclude that “lower net absorption is likely a lasting trend.”

What does this mean for city economies? While it may mean that fewer office buildings get built than would have been the case if the old space-per-worker ratios had held, it also suggests that the current building stock has more capacity to accommodate additional jobs than it did in the past. Even without building new offices, cities can expand employment. Greater space efficiency also means that companies will have to pay to rent fewer square feet per employee, meaning that the cost of office space is a relatively less important factor in driving business costs. Commercial real estate brokerage CBRE estimates that for a typical 500-employee software firm, office expenses represent just 6 percent of costs, compared to 94 percent for employee labor.

And notice that this analysis estimates that firms have an average of about 150 square feet per employee (75,000 / 500). If occupancy rates are as low as 50 to 100 square feet per employee as the new Reis analysis suggests, office costs may be even lower as a fraction of total costs. More space efficient businesses are more likely to locate in urban centers, where the advantages of accessibility, and proximity to a wide range of services and activities is an advantage in attracting and retaining talent.

Ultimately, this should also make a significant difference to how we plan and build our cities. Many land use plans assume fixed, or even growing, ratios of space per worker. That’s part of what prompts cities to plan for growth at the “extensive margin”–i.e. by setting aside more land for further commercial and industrial uses, often at the urban fringe. But the shrinking footprint per worker suggests that we’ll need a lot less land for this kind of extensive growth because we can accommodate more employment by using our existing lands and buildings more efficiently, i.e. growing at the intensive margin.