Inclusionary zoning programs are too small to make a dent in housing affordability

Two of the most respected names in housing research are Lance Freeman and Jenny Schuetz. Freeman is professor urban planning at Columbia University and author of a series of papers examining neighborhood change, and considering whether and when gentrification leads to the displacement of neighborhood residents (it’s rare). Schuetz is an urban economist, now working for the Federal Reserve, who’s written an impressive series of papers addressing everything from mortgage foreclosures, to neighborhood retail, to the effects of land use regulation on housing prices. Earlier this month, Freeman and Schuetz co-authored a new paper on housing affordability policies for the Department of Housing and Urban Development’s quarterly Cityscape journal.

Their article poses the question “Producing Affordable Housing in Rising Markets, What Works?” The paper looks a range of state and local policies to subsidize or facilitate the construction of more affordable housing, including statewide housing fair share laws, direct subsidies, support from tax increment financing and inclusionary zoning (IZ).

At City Observatory, we’ve been highly skeptical of the effectiveness of inclusionary zoning. While inclusionary zoning gets top mention as a preferred policy by many affordable housing advocates, there’s precious little evidence that its ever had more than a token effect on the size of the housing affordability problem in any city. In addition, because inclusionary zoning requirements essentially shift the cost of housing subsidies onto new development, they raise its cost, and likely reduce the number of units that get built–which tends to aggravate housing shortages and further accelerate prices. We’ve written that inclusionary zoning has a scale problem, and its a question that this paper investigates directly.

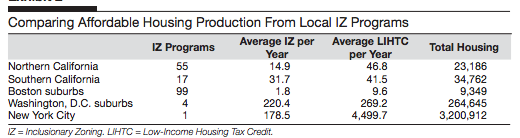

Here’s the quantitative evidence to that point: Freeman and Shuetz compiled data on 150 different inclusionary zoning programs in five different regions of the country. To illustrate the scale of these inclusionary zoning programs relative to the market, they show the total number of existing housing units in 2000 in the jurisdictions with inclusionary zoning, and for reference show the number of units financed through the federal Low Income Housing Tax Credit (LIHTC)

They conclude:

Average annual production under local IZ programs varies systematically across regions, but in all areas has contributed only a modest amount of affordable housing. * * * Expressed as a share of the existing housing stock, affordable housing produced under IZ is less than 0.1 percent of existing housing in all regions.

One of the big questions about inclusionary zoning is whether the added costs imposed on developers increase the price and depress the supply of market provided housing, thereby offsetting the (small) gains from affordable units. In Seattle, Sightline’s Dan Bertolet has calculated that if the added cost of IZ requirements reduces construction by just two apartment projects, it will more that offset the positive supply effect from the inclusionary affordable housing construction. Freeman and Schuetz only briefly touch on the questions how the cost of inclusionary zoning’s requirements are likely to affect housing supply and prices. They observe:

Existing research has found mixed results of local IZ programs, with some evidence that IZ contributes to higher housing prices, reduced construction, and a shift toward smaller housing units, but these effects vary across regions and time periods.

In their policy recommendations however, they are quite clear: local governments should reduce cost-increasing zoning and building requirements, and up-zone residential areas, allowing for more apartments and accessory dwelling units. If you take that advice at all seriously, you should think twice before imposing an IZ mandate on new development.

We understand the political attractiveness of inclusionary zoning programs, they don’t seem to cost any money: You require developers to build 1 or 2 affordable housing units for every ten new apartments that they build. Maybe your city offers up a density bonus, or expedites permit handling, but unlike conventional public housing, the city doesn’t have to lay out any of its cash to get more new affordable housing. That’s why Evan Roberts of StreetsMN described it as politically understandable, though terrible policy. Its the kind of solution that is congruent with a kind of morality-tale explanation of housing unaffordability: it’s the fault of greedy developers and heartless landlords, so its only fair to somehow dragoon them into paying for the solution.While showy and contentious, however, the real world results of inclusionary zoning have been at best paltry, and the risks that inclusionary requirements will depress housing supply–and thereby drive up rents, ought to persuade policy makers to look more broadly if they are to find practical solutions to this problem.