For decades, urban economists have chronicled the steady decentralization of employment in our metropolitan areas. First people moved to the suburbs for low density housing, and then businesses followed—especially retail and service businesses that catered to decentralized population. Over time, the manufacturing and distribution business which had traditionally chosen city-centered transportation hubs also moved to more sprawling locations, enabled by the shift to truck transportation and the growth of the nation’s highway system.

A few industries continued to be disproportionately found downtown. Banks, insurance companies, government offices, and many professional service firms still preferred central office locations that facilitated easy face-to-face contact. But retail moved increasingly to suburban malls and highway strip centers, manufacturing and distribution to industrial parks, and many clerical and administrative functions moved from the center to more dispersed office parks.

At City Observatory, we’ve tracked the growing movement of talented young workers back to urban neighborhoods. The growing attractiveness of urban living is leading to measurable increases in skill level of the labor force near city centers. Employers are taking notice: a growing number of firms report that they are choosing downtown locations in order to tap into the growing talent pool of young workers.

We’ve identified dozens of examples of these downtown moves and expansions, which led us to ask whether this was actually moving the needle in city center employment levels. We tapped a novel and relatively new data source, the Census Bureau’s Local Employment and Housing Dynamics (LEHD) series. It maps, block-by-block, the location of jobs in most of the nation’s metropolitan areas. Building on a research methodology developed originally by Ed Glaeser and Matt Kahn, and further applied by Brookings researcher Elizabeth Kneebone, we focused on the number of jobs within a three-mile circle surrounding the center of the central business district of each of the nation’s largest metro areas. We used a similar technique, and different data, as part of our Young and Restless report in October.

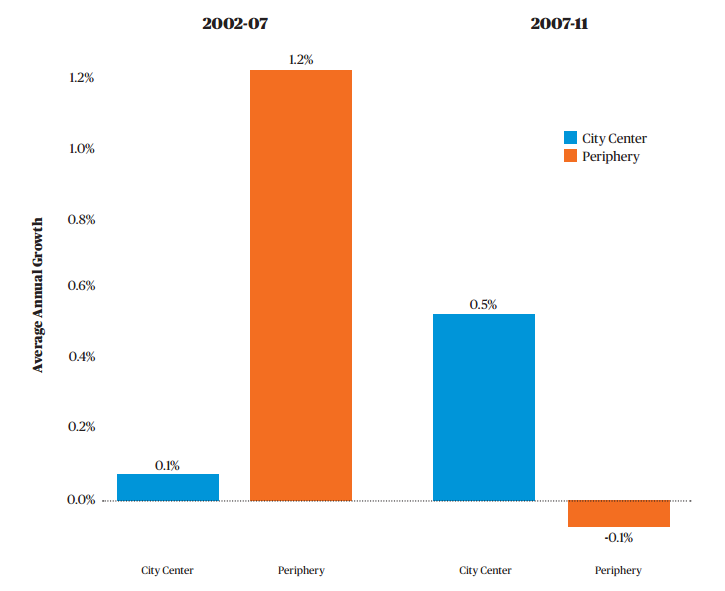

Looking back over the past decade, we found a remarkable reversal in the pattern of job growth. During the economic expansion from 2002 to 2007, the historic trend of job decentralization was very much present. City centers saw employment growth of barely one-tenth of a percent per year, while the more outlying areas grew ten times as fast.

But since 2007—the period coinciding with the onset and early recovery from the Great Recession—the picture changed dramatically. In the aggregate, the 41 metropolitan areas for which we have comparable data showed a 0.5 percent per year growth in city center employment and a 0.1 percent decrease in employment in the periphery. While only 7 city centers outperformed their surrounding metros in the 2002-07 period, 21 outperformed the periphery in 2007-11. This is a widespread trend, however the change isn’t yet universal. The growth rate of outlying areas still widely outstrips that of the city center in a half dozen metropolitan areas including Houston, Kansas City, and Las Vegas.

Data documenting this reversal come from an extremely volatile period in our recent economic history—2007 to 2011, covering the time from the peak of the last economic cycle through the trough of the Great Recession, and the first two years of recovery. We know that cyclical factors, particularly the decline in construction and goods-producing industry, caused the economic blow to fall heavily on more decentralized businesses.

To separate out the effects of the economic cycle from underlying trends in city center competitiveness, we developed a shift share analysis that looks at the change in employment by industry sector. This analysis shows that while more centralized industries outperformed decentralized ones, this factor alone didn’t account for the city center growth. Compared to the previous period, city centers actually erased their competitive disadvantage relative to suburbs, and in some industries (arts, entertainment, dining, lodging, and finance, insurance, and real estate) clearly outperformed more peripheral locations.

We think that there are a number of reasons to believe that the relatively strong performance of city centers will be maintained in this economic expansion. As we noted in our Young and Restless report last year, talented young workers are increasingly choosing to live in and near city centers. Just as the outward migration of population propelled employment decentralization in the last century, it may well be that the movement of population back to the center will sustain employment growth in city centers.

We look forward to following this trend as more data becomes available; to read the full report, go here.