Note: Tomorrow, NYU’s Furman Center will hold a seminar with Dartmouth professor William Fischel on his new paper,”The Rise of the Homevoters: How OPEC and Earth Day Created Growth-Control Zoning that Derailed the Growth Machine.” This post contains some of our reactions to the paper.

There’s increasing recognition that laws preventing the construction of new housing in high-demand neighborhoods—”the new exclusionary zoning” (a phrase coined in this excellent paper by John Mangin)—is a problem, driving up housing prices across entire metropolitan areas and increasing segregation. Less talked about is where these regulations came from.

Last November, we wrote about one influential theory on that count, from Dartmouth professor William Fischel. His 2015 book, Zoning Rules!, suggested that the big shift to broadly exclusionary zoning happened in the 1970s, and that there were five big culprits:

- Highways that greatly increased housing demand in suburban communities

- The Civil Rights Movement, which threatened to integrate previously segregated areas

- The granting of more powerful legal standing to opponents of development

- The creation of more complicated development processes with multiple veto points

- The rapid growth of housing prices in 1970s, combined with a period of high inflation

In a new paper, Fischel again addresses how, and why, American cities became so much more restrictive on housing growth in the 1970s. The broad outlines are the same: Rapid inflation in the beginning of the decade, combined with tax policies that favored housing investments over other financial vehicles like the stock market (think the mortgage interest tax deduction and capital gains exemption) made homeowners start thinking of their homes as “growth stocks” rather than stable investments. Those expectations drove homeowners to more aggressively pursue policies that would protect their investments, including preventing new developments that might drive down prices either by creating disamenities like traffic or noise, or simply creating more competing sellers.

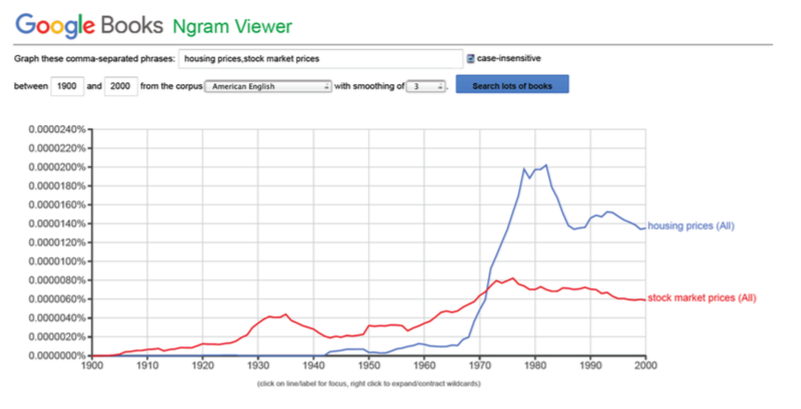

A Google Ngram of mentions of “housing prices” in American books shows how quickly housing values became an issue at this time:

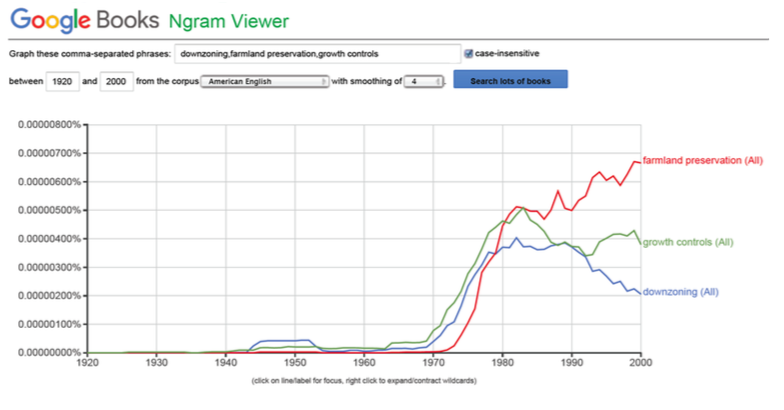

…and how talk of “growth controls,” “downzoning,” and “farmland preservation”—all ways to reduce housing construction and inflate prices—took off at exactly the same time:

He also expands on some of the regional aspects of “the new exclusionary zoning,” as this shift has been called. Notably, large metropolitan areas on the East and West coasts have seen the most dramatic move to building restrictions. These changes have resulted in drastically different regional housing prices; while the difference in real estate values between, say, metropolitan Atlanta and metropolitan San Francisco was relatively small prior to the 1970s, it has since widened substantially. Perhaps more strikingly, even non-coastal areas that have seen huge increases in jobs and population over that period—say, Phoenix or Houston—have kept housing prices relatively low. And while natural barriers to construction have often been cited as a reason for low housing production and high prices in coastal cities, Fischel points out that there are many interior cities with similar barriers: Washington, DC, for example, is not meaningfully more hemmed in by the Potomac than Chicago is by Lake Michigan, or than St. Louis is by the Mississippi.

Rather, Fischel points to institutional factors. Metropolitan areas in the Northeast are generally made up of many geographically small municipalities, which allows homeowners to heavily influence the local bodies that make zoning decisions. Sunbelt local governments, by contrast, are generally much larger, making hyper-local anti-development politics harder to organize. (Previously, we’ve covered the evidence that more fragmented governments tend to be more restrictive on development. Finally, although the West Coast generally lacks the Northeast’s extreme jurisdictional fragmentation, Fischel argues that ballot referenda still allow homeowners to directly exert their influence. Another factor is the prisoner’s dilemma: if some local jurisdictions effectively put in place growth controls, other jurisdictions have strong incentives to implement their own growth controls to avoid becoming a “dumping ground” for unwanted residents or land uses.

And yet, evidence also suggests that housing price growth itself leads homeowners to demand more restrictive housing laws. And while the Northeast and West Coast are not the only regions to see rapid population and employment growth, they have seen the fastest growth in high-paying jobs that require high levels of education, attracting the sort of workers with the ability to bid up prices. “This suggests,” Fischel concludes, “that if economic shifts occur that make Chicago and St. Louis the favorite destinations of high-skilled, college-educated workers, the cities of the Midwest will become the centers of growth controls and rising housing prices.”

As before, the big takeaway is that restrictive zoning is not an accident, nor a policy imposed by top-down planners, but something that is demanded by voters—particularly homeowners—who are, at least in part, responding to their own financial incentives. Any plan to reform zoning needs to address those voters and their interests. That’s why the path to more plentiful and cheaper housing may begin with measures that aim to reduce the weight homeowners put in their homes as financial investments, including rolling back the mortgage interest tax deduction and treating capital gains on housing like other capital gains for tax purposes.