Behind the big headlines about an national income rebound: thriving city economies are the driver.

As economic headlines go, it was pretty dramatic and upbeat news: The US recorded an 5.2 percent increase in real household incomes, not only the first increase since 2007, but also the biggest one-year increase ever recorded. Its a signal that the national economy is finally recovering from the Great Recession (the worst and most prolonged economic downturn in eight decades).

Fittingly, The Wall Street Journal headline proclaimed the good news:

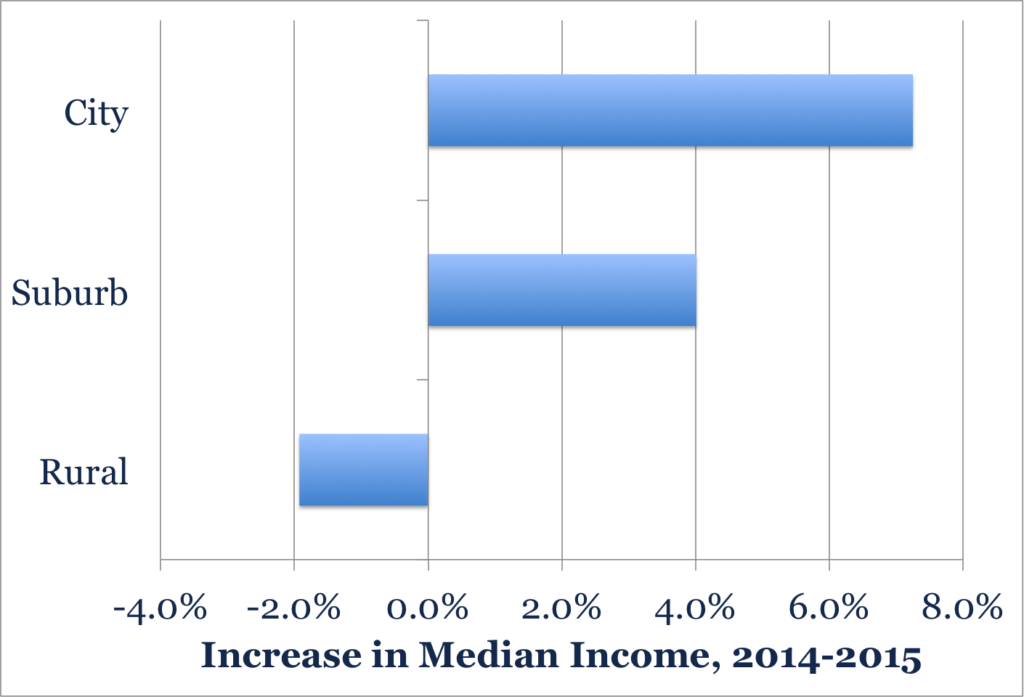

But dig deeper into the data, and there’s an even more interesting development: The big growth in US incomes was powered by the growth in incomes in cities. The following chart shows the inflation-adjusted change in incomes between 2014 and 2015 for the nation’s cities, suburbs and rural areas. The key numbers here are seven, four and two: the average city household’s income grew seven percent, the average suburban household’s income grew four percent and the average rural household’s income declined by two percent. (NOTE: This two percent decline appears to be an error based on changed geographic definitions for what constitutes rural areas, see our comment below). The more urban you were in 2015, the faster your income rose.

Source: Census Bureau, Income and Poverty in the United States: 2015

For those who follow this data closely, this is yet another strong piece of evidence that the US national economy is being powered by what’s happening inside cities. If the nation’s incomes had grown only as fast as those in rural and suburban areas, the national income increase would have been cut roughly in half, to an underwhelming 2.5 percent. The gain in city incomes hasn’t escaped the attention of other analysts. At Vox, Tim Lee flagged the disparity between city and suburban and rural income gains, summarizing it as “a fundamentally urban recovery.”

As we pointed out last year, urban centers are, for the first time in decades, gaining jobs faster than their surrounding peripheries. Measured by job growth, large metropolitan areas–those with a million or more population–have grown much faster than smaller metros and rural areas. The shift to the center is also reflected in housing prices; homes in vibrant urban centers have registered significant increases relative to the price of suburban homes.

There’s an unfortunate tendency to portray this data in a “winners” and “losers” frame: Vox headlines its story as cities getting richer and rural areas getting left behind. But really what’s at work here is a fundamental shift in the forces that are propelling national economic growth. The kinds of industries that are growing today, in technology, software and a range of high value services, are industries that depend on the talent, density and vibrancy of city economies for their success. It’s not that we’ve somehow simply reallocated some activities that could just as easily occur in rural areas to cities; much of this growth is uniquely the product of urban economies.

A particularly misleading connotation of the word “recovery” is that it seems to suggest that in the wake of a recession, economies rebound simply by restoring exactly the kinds and patterns of jobs and industries they lost. What really happens is what Joseph Schumpeter famously called “creative destruction”: the economy grows by creating new ideas, jobs, and industries, often in new locations. As we shift increasingly to a knowledge-driven economy, that process is occurring most and fastest in the nation’s cities, where talented workers are choosing to live, and where businesses seeking to hire them are starting, moving and expanding.

This is not your father’s or your grandmother’s recovery. The US economy is changing in a fundamental way to be more urban-centered and urban-driven. Its an open question as to whether we’ll recognize that this is now the dynamic that drives the national economy, and fashion policies that capitalize on cities as a critical source of economic strength.

A few technical notes

The data for these estimates come from the Current Population Survey which is used to generate national estimates, rather than the more fine grained geographies reported in the American Community Survey. For its annual report on income and poverty, the Census Bureau provides only a limited geographic breakdown of income data. Specifically, they report the differences in income and poverty for metropolitan and non-metropolitan areas, and within metropolitan areas, the differences between “principal cities”–generally the largest and first named city in a metro area–and the remainder of the metropolitan area. Although city boundaries are less than ideal for making geographic comparisons at the national level, it is a rough, first-order way of charting the different trajectories of cities and suburbs.

When the 2015 ACS data becomes available later this year, we and others will want to examine in more closely to better understand the broad trends from this week’s report.

UPDATE: September 19: Census Report likely under-estimated rural income growth

The New York Times Upshot points out that the reported decline in incomes in rural areas is probably an error, due to the changing definition of what constitutes “rural” areas in the Current Population Survey.