Cities are becoming more important to the economic health of the country. How do we know? We can boil the answer down to four charts, each of which plots a key indicator of urban economic strength.

1. The Dow of Cities

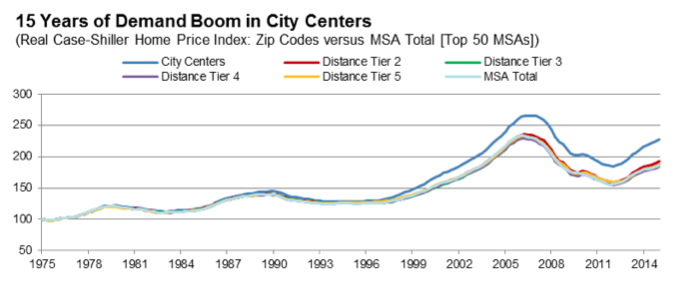

The market value of housing in urban centers is increasing much more rapidly than in more outlying areas, signalling the growing economic importance of central locations and urban living. Since 2000, according to calculations by Fitch Ratings, using data from the Case-Shiller Index, home prices in urban centers have increased 50 percent faster than in more peripheral locations. We call this the “Dow of Cities” because—like the Dow Jones Industrial Average—it signals the increasing value and success of cities.

2. The Rent Gradient

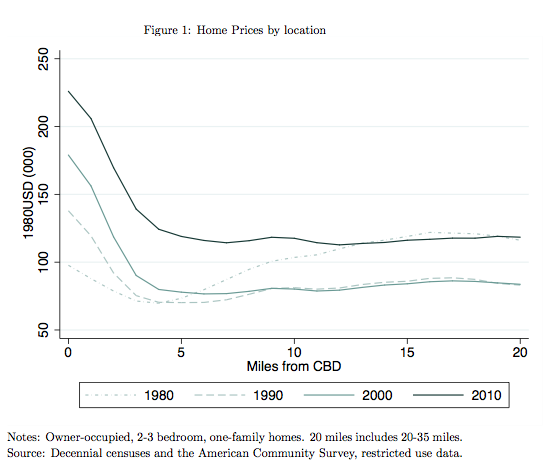

The way housing prices change as you get further from a city’s downtown is called the “rent gradient.” Over the past four decades, the rent gradient has become much steeper—meaning people are willing to pay more of a premium to live in more central locations. Census data compiled by economists Lena Edlund, Cecilia Machado and Michaela Sviatchi show that this trend is particularly pronounced in the nation’s largest metro areas.

3. The Walkability Premium

A key feature of urbanism is walkability, and there’s a strong correlation between walkability—as measured by Walk Score—and increases in home values. Compelling evidence marshalled by Spencer Raskoff and Stan Humphries in their book Zillow Talk illustrates this trend. Over the past 14 years, the most walkable homes—those rated as “walker’s paradises” and “very walkable”—have consistently outperformed houses in lower-scoring, “somewhat walkable” and “car-dependent” neighborhoods. Although all types of homes saw value declines when the housing bubble burst, houses in walkable neighborhoods have recovered most, and fastest.

4. Job Growth in Large Metropolitan Areas

The success of cities is not just a local phenomenon—it has national implications. In this economic expansion—in the wake of the Great Recession—national job growth is being led by the rapid expansion of the nation’s largest metropolitan areas. According to Bureau of Labor Statistics data compiled by Oregon economist Josh Lehner, employment in the nation’s largest metro areas has increased three percent since 2007, compared to an increase of less than one percent percent in smaller metropolitan areas. Rural areas still have yet to recover their pre-recession levels of employment.

Taken together, these trends tell a compelling story about the economic importance of cities and large metropolitan areas. There’s a growing market demand for urban living. Americans are attaching an increasing value to living in cities, and especially in walkable neighborhoods. And the American economy is increasingly propelled by the success of large metropolitan areas anchored by strong central cities.

The primary implication of this work is that we need to capitalize on the economic power of cities. In addition, while rising prices signal a resurgence of city economic strength, they also pose an important public policy challenge: how to address housing affordability. In our view the underlying issue is what we’ve called a shortage of cities and we can best meet this challenge by improving cities everywhere and also by expanding the opportunities to live in cities by building more housing and doing a better job of helping low income households afford housing. On that front, the evidence points to a two-pronged approach. First, in regions where housing demand strongly outstrips supply, allowing more housing construction is crucial to reducing overall housing prices. Second, we need to dramatically increase direct housing assistance to low-income people who have trouble purchasing housing even in normal markets—for example, by making Housing Choice Vouchers an entitlement.